To say that Jamie McCall is passionate about research is an understatement. Fortunately, as the Vice President of Economic Development Policy at Carolina Small Business Development Fund (CSBDF), a statewide community development financial institution (CDFI) based in Raleigh, research, policy analysis, and program evaluation are at the core of what Jamie gets to do each and every day.

Through his research, Jamie explores the importance of small- and medium-sized businesses for sustainable and effective regional growth, and besides peer-reviewed articles, organizational white papers, and presentations at national conferences, Jamie has also authored several academic book chapters on topics related to community economic development. In addition to his role at CSBDF, Jamie is an adjunct instructor within the University of North Carolina at Chapel Hill’s School of Government, where he received his Master of Public Administration.

Through his research, Jamie explores the importance of small- and medium-sized businesses for sustainable and effective regional growth, and besides peer-reviewed articles, organizational white papers, and presentations at national conferences, Jamie has also authored several academic book chapters on topics related to community economic development. In addition to his role at CSBDF, Jamie is an adjunct instructor within the University of North Carolina at Chapel Hill’s School of Government, where he received his Master of Public Administration.

We caught up with Jamie to talk about his unique research, and we got the chance to hear his thoughts about the idea of CDFI self-sufficiency, the need for better impact reporting, and how the CDFI industry can elevate the role of research.

CNote: Can you talk a little about your background and how you found your way to CSBDF?

Jamie McCall: After graduate school, I started working for the state government’s nonprofit development corporation as a research analyst. When any public or quasi-public entity says they are engaging in “economic development,” it almost always means a focus on recruiting large businesses. Thus, most of my work involved supporting business recruitment and/or expansion efforts. I got to work on things that were interesting and challenging, but I didn’t have a passion for it. I knew what the research says: small business is the cornerstone of community economic development. I started looking for other positions, and one of my former colleagues was on the policy and research committee here at Carolina Small Business Development Fund. She said, “you’re gonna love it.” I applied and obviously took the job. I was immediately thrown into a world that I was not familiar with, but it was a world that I was really excited about. Though I knew CDFIs were essential actors for holistic and sustainable development when I took the job I was only vaguely aware of the industry.

CNote: How do you explain CDFIs to someone who’s never heard of them?

Jamie McCall: I usually give the example of a big business like Amazon. Even when they were early on in their growth, if they needed money to do something like build a new warehouse, they could go to a bank. As a company, they’re stable, and so they have no problem getting credit for expansion purposes. But when you deal with small- and medium-sized businesses, which are really the foundation of regional economies, in most cases, they cannot get any sort of financing to start or grow what they’re doing. That’s because those businesses don’t have enough scale to be financially stable enough that banks find them to be good targets for financing. They don’t fit traditional lending profiles, and for the most part, banks view those businesses as being higher risk.

CDFIs come into the picture because they do not have that sort of framework of profit motivation that banks have. There are of course for-profit CDFIs, but they are the exception and not the rule. So, the role of CDFIs is to come in and fill in that gap for businesses that are higher risk. They don’t make loans with the goal to make money, but they know that those businesses are going to take that loan money and they’re going to expand, add staff, and buy things. For every $1 that you give a small business that does that, there are multiple dollars in return in terms of economic impact. So, if a CDFI does its job well and a business is able to grow and expand, then that business can now access more capital from the traditional banking system. And from there, it’s sort of like a snowball effect. It often seems strange to people that debt is an economic development tool, but it’s really how you get businesses to grow.

CNote: Can you talk a little more about that multiplying effect with regards to small business lending impact in your region?

CNote: Can you talk a little more about that multiplying effect with regards to small business lending impact in your region?

Jamie McCall: For our last fiscal year, for every dollar that went out, the return to the economy was $1.01. With a $1.01 multiplier, you are doubling your money in terms of economic impact. That multiplier changes a bit from year to year, which is why we conduct yearly economic impact analyses. In some years, it’ll be lower or higher, and it’s very industry-dependent. We know that it is hard to measure the economic impact of small businesses, which is why one of my lines of research is also looking at social impact multipliers. If a CDFI does its job correctly and a small business is given a level of debt that it can handle, then what you end up with is successful entrepreneurs who become embedded in their community. These small businesses end up building these really robust social networks with other small firms, with their suppliers, and within their community. We saw with COVID how the businesses that were able to survive were those that have those really strong social networks in place. So, there’s both an economic return on investment and a social return. The social return is much harder to measure, but I think it’s just as important.

CNote: Can you explain that idea of social capital network a little more? Why is it so important?

Jamie McCall: When you look across the CDFI industry and people talk about impacts, it’s most often expressed as the number of jobs created or saved, amount of capital lended, number of loans, the average size of loans, and things like that. Those are not necessarily bad indicators. They are one type of indicator, but they do not tell the full story. I often say that jobs are not the primary impact of CDFI work, because if we go in and we give people lots of loans and they create lots of jobs, the question which usually comes up is what is the “quality” of those jobs. But we know in general small business jobs they’re not going to be as good as a similar position would beat larger corporations. To me, the question that we should be asking is: how do the people in those jobs improve the community?

For example, we know that when people work in a small business, they tend to come from that community and they tend to live and work in the same place. That’s extremely important for community economic development because that allows relationships not just between small businesses and other small businesses, but relationships between small business employees and their community to really develop. Those interactions have such a high return on investment. Importantly though that return is mostly social (and not economic) because what they do is increase levels of community trust. It also increases trust in institutions, which is really important, especially for urban problems like trying to find ways to lift people out of poverty, because people have a legitimate distrust of institutions.

What we have found again and again, and what the research shows, is that social networks have immense economic value, but that value is hard to measure. It’s not that jobs aren’t important: we want to create jobs. But, we have to acknowledge the limitations of that. As a CDFI researcher, I would much rather say we didn’t create a single job, but we increased trust in this community and its institutions by two percentage points. That has a much higher impact than creating 200 jobs.

CNote: As a researcher, what role do you think research has to play in the CDFI industry, and what research gap are you trying to fill?

Jamie McCall: I think people, and especially policymakers, tend not to view CDFIs to be as integral to community economic development as they really are, and that’s where I think the role of research and education comes in. CDFIs do not have a foundation of research like other economic development interventions do. I can give you volumes on affordable housing. I can give you volumes on business recruitment. But when it comes to CDFIs, especially small-business-oriented CDFIs, there’s nothing. For me, that’s what I want to do: lay out why these institutions are important and why supporting small business is important, empirically. It’s not just me. The Federal Reserve’s community development division has lots of great work here in this area, and some CDFIs have research staff, but because CDFIs are low-capacity organizations, most of them don’t have research staff. Even those that do, they’re still capacity constrained.

What I’ve found with CDFI research, however, is there’s a lot of good qualitative research that I think is really important, but there’s no willingness to engage critically with it. I want people to ask me critical questions about what I’m doing in terms of research because that’s the only way we get better. I would much rather somebody in the CDFI industry find a flaw in an article I’ve written than somebody in Congress. That kind of engagement isn’t a personal attack. For example, we recently had an article on CDFI program evaluation accepted at Community Development and six independent peer reviewers who are experts in this area reviewed it. Their job is to basically tear it apart, but what that does is essentially make sure that the quality of the research is unquestionably high. No peer review system is perfect, but I’m willing to subject my work to the highest levels of scrutiny, and I think that as an industry, we need to do more of that. If we do, we’ll be in a much stronger position.

CNote: What are your thoughts on CDFIs who’re aiming to be self-sufficient, financially sustainable organizations?

Jamie McCall: I think that’s probably one of the hardest things to do in the CDFI world. Most of the things that we do that help people the most are not profitable. What happens when CDFIs are self-sustaining, they sort of have these lines of business that maybe aren’t what you would consider to be targeting traditional CDFI borrowers. For example, let’s say a CDFI engages in some profitable line of business that really in some way benefits larger, white-owned businesses, but then they use that money to benefit smaller minority-owned businesses that are more in line with CDFI demographics. Are they doing good? To me, the main challenge with self-sufficiency is that it requires that sort of activity, and I don’t think we have enough research or data to really confirm if this is a net positive or not.

In an ideal world, I think CDFIs should be subsidized. This isn’t an activity that is innately profitable, but it does a lot of good for the money that you put into it. So, in a perfect world, CDFIs would receive public subsidies, and although sufficiency is admirable and I think it should be a goal, I don’t know how you do it in a way that doesn’t cause net bad or net harm, at least not until we’ve done more research on it. That’s an example of where we need research and why we need to do research on these kinds of questions.

CNote: Any current research or recent findings that you want to share with us?

CNote: Any current research or recent findings that you want to share with us?

Jamie McCall: Yes, the peer-reviewed article on CDFI program evaluation I mentioned earlier, which was accepted at Community Development. I’m excited about it because it is the first article in many years that looks at CDFIs specifically and not in the context of something larger. Like I said before when you look at most types of economic development interventions, there’s a body of literature I can point you to, but I can’t do that with CDFIs. From a policy perspective, that’s important to long-term sustainability.

In this article, we explore the role of program evaluation for CDFIs and try to outline some best practices. What we found is, besides capacity constraints, funders of CDFIs often have competing demands for what they want in data and evaluations. There is no validated sort of model of evaluation or agreed-upon performance metrics for the industry, so everybody uses different definitions, so you can’t compare anything. What we suggest in this article is that this is the starting point for a serious conversation: this isn’t going to be solved overnight.

CNote: What’s holding CDFIs back from doing the kind of impact evaluations that you talk about in your research article?

Jamie McCall: I believe CDFIs want to do evaluations, but they’re not incentivized to do them, and evaluating impact costs time and money. So you have very few CDFIs that do any sort of robust evaluation work in the first place. Then funders either inconsistently use the evaluations that do exist or worse, they use them as sort of a weapon if the evaluation doesn’t show good things. So, CDFIs are like “well, nobody asked for one, and if it ended up being bad, we’d probably be punished for it, so we’re just not going to do an evaluation.” That means we just keep doing this thing where we talk about the amount of money we give in loans, and what percentages went to what demographics, and how many jobs were created or saved. That frustrates me extremely because the work that CDFIs do is so much more. And I am the first person to admit that it’s so hard to measure, and the smaller the CDFI, the more limited the resources, the harder it is. The theory of change that most CDFIs are operating from is extremely complex. But that doesn’t mean you can’t start somewhere. You acknowledge the limitations and say “we care enough about the communities we serve that we have to start somewhere because it’s far better than what we’re doing.”

I want to stress that this isn’t a criticism of CDFIs. Throughout the Community Development article for example we say that CDFIs are vital to community economic development. The question is not whether or not CDFIs are important. They are. The question is not whether or not CDFIs are having a positive impact. They do. The question is how can we better show that in a manner that creates a positive feedback cycle for CDFIs to get more resources and be more effective.

CNote: Thinking about impact, what kind of impact or impact metric do you think doesn’t get enough attention in the CDFI industry?

Jamie McCall: I can provide evidence up and down about the social capital impact that CDFIs have and how people’s lives are positively influenced by their work, but I’m never asked for that. I’m asked for how many loans, what percentage went to minorities, what’s the default rate, and how many jobs were created. And I understand why those types of questions are the ones that get asked. Because the goal is to take people that have really, for either institutional or personal reasons, been unable to access credit and make sure the capital goes to those places, and I understand the need for that, but it cannot stop there.

The next question should be “what was the net impact,” and with so few exceptions, nobody ever asks that. And again, I am not saying that is an easy question to answer. I get that CDFIs are financial institutions, but if I’m being asked about default rates, I should also be asked about what impact we were also able to make. Instead, it’s almost like any sort of thought about impact or how these things have improved the lives of the community is thought of as something that’s good if it happens. But it often doesn’t seem like the primary objective. So what we end up with is a very odd incentive structure where the CDFIs that are the most successful are those that tend to act most like banks.

It’s not their fault: the incentive structure we have does not always encourage mission-oriented lending. To me, that’s a problem, because mission-oriented lending is the entire reason why the CDFI designation was created. If CDFIs are incentivized to simply do more loans, it can encourage things like giving loans to people who could go down the street to the bank and get one. That is why I am against merely counting loans as impact. I would much rather give 50 loans where we have built a relationship with somebody to where they really know that we’ve invested in them and they want to invest in their community then give 1,000 loans to people who have no idea who we are and who just fill out an application on the website.

CNote: With recent announcements about the federal award program and increased investor interest, do you think it’s accurate to say that CDFIs are having a moment?

Jamie McCall: I know the Vice President has made CDFIs one of her issues of importance, and I think, to my knowledge, that is the first time that that has been done since probably the Riegle Act was signed during the Clinton administration. The challenge is keeping that level of high visibility support up. I think in order to really take advantage of this moment in the policy cycle, what CDFIs have to do is take this opportunity to be honest and say, “in our industry, evaluating our impact is hard, but we believe it’s important. Here’s what we can show now, and here’s our commitment to continuing to show the story of the people we support in the future.” CDFIs aren’t a partisan issue, but today, I think that you have to be very intentional in that in a way that’s bipartisan.

I also think that, for example, with the PPP loans, which were very profitable for CDFIs, we need to have a retrospective on that, because CDFIs are going to have to deploy forgivable loans again in the future, god forbid after another Hurricane Katrina-type scenario or another pandemic. There have been questions about whether or not PPP loans got CDFIs away from their core mission. I think that’s a valid question, especially with forgivable loans that were available so widely and not just targeted at marginalized constituencies. We need to have a retrospective to make sure that in some future time, we can do those types of things in a way that doesn’t hurt the other things that we should be doing.

CNote: How can the CDFI industry elevate the role of research?

Jamie McCall: When I think about CDFI research, the case studies I’ve seen are really impressive. That kind of qualitative research is usually what CDFIs produce to show their impact, and they do a good job at highlighting that. Because when done correctly, CDFI methods of intervention can change lives. That fact is one of the reasons why CSBDF’s slogan is “We are dreamcatchers.” But what I have struggled with is sort of attempting to acknowledge that good part, and then have people have a willingness to have a conversation about these other issues around impact measurement and evaluation. These issues are things that need to be elevated by the industry. I know that there have been attempts in the past, and again I know it’s hard, but this is something that could be elevated by organizations like OFN. This is also something that the really big CDFI funders should step in and say “we care enough about this that we’re going to do things like fund research because we want to better show the impact of CDFIs. We currently can’t, so let’s find out ways to do it.” Then we could make more than incremental improvements.

The responsibility for these issues is not just CDFIs’. It’s everybody involved in this industry: it’s the advocacy organizations, it’s the funders, it’s the regulators. They all have a role. That has to be recognized, and there has to be this agreement that it’s worth the very hard work of trying to improve things. I dream big.

To assist his community where he can, Rich is working with local leaders to change how Beardstown’s tax increment financing (TIF) programming works so that a portion of those monies can go toward creating new housing. Additionally, Beardstown Savings has partnered with

To assist his community where he can, Rich is working with local leaders to change how Beardstown’s tax increment financing (TIF) programming works so that a portion of those monies can go toward creating new housing. Additionally, Beardstown Savings has partnered with

For Labor Credit Union, however, its involvement with Dora isn’t about growing its membership: it’s about achieving its own long-term goals. Although Thomas and Hina’s 10-year vision for the credit union includes growing its membership numbers, increasing its assets, and expanding its footprint into new markets, those metrics are stepping stones toward Labor Credit Union’s ultimate objective: to have an impact and help people achieve financial success in as many communities as possible.

For Labor Credit Union, however, its involvement with Dora isn’t about growing its membership: it’s about achieving its own long-term goals. Although Thomas and Hina’s 10-year vision for the credit union includes growing its membership numbers, increasing its assets, and expanding its footprint into new markets, those metrics are stepping stones toward Labor Credit Union’s ultimate objective: to have an impact and help people achieve financial success in as many communities as possible.  That, in part, is what led Labor Credit Union to create its own foundation, which spearheads the institution’s community outreach efforts.

That, in part, is what led Labor Credit Union to create its own foundation, which spearheads the institution’s community outreach efforts.  Learn More:

Learn More:

Learn More:

Learn More:

Although NYU Federal Credit Union’s assets have grown considerably since Mira joined in 2006, the credit union is still too small to carry a high number of mortgages on its balance sheet, despite the demand from its membership. Therefore, to meet its members’ needs, the credit union forged a partnership with the United Nations Federal Credit Union. NYU Federal Credit Union sells its mortgages to United Nations Federal Credit Union, but holds onto 10% of each loan. In return, United Nations Federal Credit Union gets to improve its balance sheet, while NYU Federal Credit Union gets to serve more members. Last year, the arrangement resulted in NYU Federal Credit Union earning approximately $400,000 in fees, which Mira says was a “huge boost” to the credit union’s bottom line.

Although NYU Federal Credit Union’s assets have grown considerably since Mira joined in 2006, the credit union is still too small to carry a high number of mortgages on its balance sheet, despite the demand from its membership. Therefore, to meet its members’ needs, the credit union forged a partnership with the United Nations Federal Credit Union. NYU Federal Credit Union sells its mortgages to United Nations Federal Credit Union, but holds onto 10% of each loan. In return, United Nations Federal Credit Union gets to improve its balance sheet, while NYU Federal Credit Union gets to serve more members. Last year, the arrangement resulted in NYU Federal Credit Union earning approximately $400,000 in fees, which Mira says was a “huge boost” to the credit union’s bottom line.

From their humble beginnings in the Red Barn with ten students on their roster, they now have over 100 kids and are setting their sights on obtaining college gymnastics scholarships.

From their humble beginnings in the Red Barn with ten students on their roster, they now have over 100 kids and are setting their sights on obtaining college gymnastics scholarships. Learn More:

Learn More:

Another way the credit union is able to support its members is by helping them to think beyond their financial wellness to other aspects of their lives. Azul has attended countless resource fairs, where she’s forged relationships with community partners. That has allowed her to build upon Comunidad Latina’s curated database of community resources that range from English courses and citizenship classes, to medical services and college enrollment assistance.

Another way the credit union is able to support its members is by helping them to think beyond their financial wellness to other aspects of their lives. Azul has attended countless resource fairs, where she’s forged relationships with community partners. That has allowed her to build upon Comunidad Latina’s curated database of community resources that range from English courses and citizenship classes, to medical services and college enrollment assistance.

A cornerstone of Freedom First’s work is its award-winning Responsible Rides® auto purchase program, which Kim has coordinated since September of 2015. The program is geared toward low- to moderate-income earners who need their own car but struggle to afford a traditional car loan due to credit challenges. Responsible Rides®, however, doesn’t just hand out car keys. Instead, applicants must meet specific guidelines, including having a valid driver’s license, the ability to have full-coverage auto insurance, and proof of employment that goes back at least 90 days. Applicants also can’t have more than $1,500 in unpaid collections, judgments, or charge-offs. Additionally, in order to qualify for Responsible Rides®, individuals must meet with a financial counselor and complete courses on finances and budgeting, as well as car maintenance and care.

A cornerstone of Freedom First’s work is its award-winning Responsible Rides® auto purchase program, which Kim has coordinated since September of 2015. The program is geared toward low- to moderate-income earners who need their own car but struggle to afford a traditional car loan due to credit challenges. Responsible Rides®, however, doesn’t just hand out car keys. Instead, applicants must meet specific guidelines, including having a valid driver’s license, the ability to have full-coverage auto insurance, and proof of employment that goes back at least 90 days. Applicants also can’t have more than $1,500 in unpaid collections, judgments, or charge-offs. Additionally, in order to qualify for Responsible Rides®, individuals must meet with a financial counselor and complete courses on finances and budgeting, as well as car maintenance and care.

Unsurprisingly, Kim finds her work with Responsible Rides® extremely rewarding—but she isn’t the only one who feels that way. Local used-car dealers also enjoy participating in the program. An important aspect of Responsible Rides® is that individuals have the option to pick their own car, including test driving it and getting it checked by a certified mechanic. Therefore, Kim does everything she can—including doing a fair bit of research—to ensure that Responsible Rides®’ clients have positive experiences getting their cars from dealerships.

Unsurprisingly, Kim finds her work with Responsible Rides® extremely rewarding—but she isn’t the only one who feels that way. Local used-car dealers also enjoy participating in the program. An important aspect of Responsible Rides® is that individuals have the option to pick their own car, including test driving it and getting it checked by a certified mechanic. Therefore, Kim does everything she can—including doing a fair bit of research—to ensure that Responsible Rides®’ clients have positive experiences getting their cars from dealerships. Relationships are one way that Kim has been able to originate 523 loans totaling $5.9 million since she began coordinating Responsible Rides eight years ago. Kim works closely with a network of local nonprofit partners, including

Relationships are one way that Kim has been able to originate 523 loans totaling $5.9 million since she began coordinating Responsible Rides eight years ago. Kim works closely with a network of local nonprofit partners, including

In 2019, The Cheyenne River Sioux Tribe approached Jayme with an offer to take over the management of their buffalo corporation, a business corporation which operates independently of, but is owned by, the tribe. For Jayme it was a perfect opportunity to bring his expertise to an organization near and dear to his heart.

In 2019, The Cheyenne River Sioux Tribe approached Jayme with an offer to take over the management of their buffalo corporation, a business corporation which operates independently of, but is owned by, the tribe. For Jayme it was a perfect opportunity to bring his expertise to an organization near and dear to his heart.

A software coder, Akinniyi grew up in Dallas, the child of Nigerian immigrants. After attending Boston University and earning an MBA, he joined a consulting firm. Akinniyi played football in college and even had a short stint in the NFL with the Minnesota Vikings. Many of his college football teammates came from the Baltimore area and Akinniyi was drawn to the city. He saw the area’s potential, a community where an aspiring entrepreneur might make a difference. Akinniyi has long had an interest in real estate and Baltimore was a place where a new developer like himself could get involved.

A software coder, Akinniyi grew up in Dallas, the child of Nigerian immigrants. After attending Boston University and earning an MBA, he joined a consulting firm. Akinniyi played football in college and even had a short stint in the NFL with the Minnesota Vikings. Many of his college football teammates came from the Baltimore area and Akinniyi was drawn to the city. He saw the area’s potential, a community where an aspiring entrepreneur might make a difference. Akinniyi has long had an interest in real estate and Baltimore was a place where a new developer like himself could get involved.

“I would work with Baltimore Community Lending as much as I can

“I would work with Baltimore Community Lending as much as I can Akinniyi hopes his new apartment building and the larger residential community he’s planning, will provide a home for residents who want a decent place to live and thrive. Unlike unscrupulous out-of-town real estate opportunists hoping to make a quick buck, he’s staying in Baltimore and making his investments part of the solution instead of part of the problem.

Akinniyi hopes his new apartment building and the larger residential community he’s planning, will provide a home for residents who want a decent place to live and thrive. Unlike unscrupulous out-of-town real estate opportunists hoping to make a quick buck, he’s staying in Baltimore and making his investments part of the solution instead of part of the problem.

Come April 2012, however, Jason had grown bored with his full-time job, and he and his wife, Shelly, began to talk about their next professional moves — including Jason potentially starting his own brewery. The couple visited one of Jason’s old brewing buddies in Fort Collins, Colorado, who owned and operated his own brewery. Jason and Shelly toured the operation, and their time in Fort Collins left them feeling confident that they had what it took to run their own small business. Two days later, the couple met with some of Jason’s homebrewing friends back in Pagosa Springs, in Southern Colorado, and together, they decided to open a brewery by Memorial Day 2013.

Come April 2012, however, Jason had grown bored with his full-time job, and he and his wife, Shelly, began to talk about their next professional moves — including Jason potentially starting his own brewery. The couple visited one of Jason’s old brewing buddies in Fort Collins, Colorado, who owned and operated his own brewery. Jason and Shelly toured the operation, and their time in Fort Collins left them feeling confident that they had what it took to run their own small business. Two days later, the couple met with some of Jason’s homebrewing friends back in Pagosa Springs, in Southern Colorado, and together, they decided to open a brewery by Memorial Day 2013. Riff Raff Brewing Company is

Riff Raff Brewing Company is

Going forward, Jason and Shelly have considered expanding Riff Raff Brewing into Northern New Mexico and potentially Lubbock, Texas, where the two went to school at Texas Tech; however, in the short term, the couple is more interested in doing what they need to do to transition the brewery into an employee-owned business. Currently, between its two restaurants and its brew house, Riff Raff’s staff ranges from 62 to 85, depending on the season. For example, when Pagosa Springs population swells from roughly 13,000 residents to more than 50,000 during the summer months, Jason and Shelly rely on a larger pool of part-time employees to serve their customers. “I’m not gonna lie,” said Shelly, “I enjoy having our two locations. We’ll pursue opportunities that come to us naturally and that feel like the right fit for Riff Raff, but we’re being smart with our growth.”

Going forward, Jason and Shelly have considered expanding Riff Raff Brewing into Northern New Mexico and potentially Lubbock, Texas, where the two went to school at Texas Tech; however, in the short term, the couple is more interested in doing what they need to do to transition the brewery into an employee-owned business. Currently, between its two restaurants and its brew house, Riff Raff’s staff ranges from 62 to 85, depending on the season. For example, when Pagosa Springs population swells from roughly 13,000 residents to more than 50,000 during the summer months, Jason and Shelly rely on a larger pool of part-time employees to serve their customers. “I’m not gonna lie,” said Shelly, “I enjoy having our two locations. We’ll pursue opportunities that come to us naturally and that feel like the right fit for Riff Raff, but we’re being smart with our growth.” Learn More:

Learn More:

Fortunately, DREAM didn’t have to make that lift alone. Instead, the nonprofit had the support of

Fortunately, DREAM didn’t have to make that lift alone. Instead, the nonprofit had the support of  As most banks were struggling with how to navigate the Paycheck Protection Program (PPP), Carver was able to secure $6 million in PPP loans for DREAM, which allowed the organization to keep everyone employed. In the following months, Carver also helped DREAM to make sure that those PPP loans were ultimately forgiven. With that money, DREAM was able to hire and to maintain enough staff to run both online and, come October 2020, in-person classes for its charter schools. DREAM also maintained its extended-day, extended-year model, including its free afterschool and summer programming, while creating a healthy and safe environment for its scholars and families.

As most banks were struggling with how to navigate the Paycheck Protection Program (PPP), Carver was able to secure $6 million in PPP loans for DREAM, which allowed the organization to keep everyone employed. In the following months, Carver also helped DREAM to make sure that those PPP loans were ultimately forgiven. With that money, DREAM was able to hire and to maintain enough staff to run both online and, come October 2020, in-person classes for its charter schools. DREAM also maintained its extended-day, extended-year model, including its free afterschool and summer programming, while creating a healthy and safe environment for its scholars and families.

Additionally, DREAM recently signed a lease for a 100,000-square-foot space in the Highbridge section of the South Bronx, which will become the permanent home of DREAM’s charter schools in that neighborhood in the coming years. According to James, expanding DREAM’s charter schools is a direct response to what the nonprofit’s community needs and wants. For example, in East Harlem, DREAM’s waitlist is more than 1,000 students. That means that until DREAM is able to grow its charter schools to meet that demand, the organization will continue to find ways to engage with community members, create deep relationships with families, and provide ongoing services to youth.

Additionally, DREAM recently signed a lease for a 100,000-square-foot space in the Highbridge section of the South Bronx, which will become the permanent home of DREAM’s charter schools in that neighborhood in the coming years. According to James, expanding DREAM’s charter schools is a direct response to what the nonprofit’s community needs and wants. For example, in East Harlem, DREAM’s waitlist is more than 1,000 students. That means that until DREAM is able to grow its charter schools to meet that demand, the organization will continue to find ways to engage with community members, create deep relationships with families, and provide ongoing services to youth.

Outside of CUNA, Mike serves on the board of the

Outside of CUNA, Mike serves on the board of the  CNote: What’s on the horizon at CUNA that has you excited for the future?

CNote: What’s on the horizon at CUNA that has you excited for the future?

For the vast majority of its 16-year existence, the credit union has operated with a staff of two and volunteers as available. Last year, the credit union received grant funding enabling it to hire additional staff members—a marketing specialist and member service representative. As a team of four, they work together to provide amazing customer service and outreach to community members.

For the vast majority of its 16-year existence, the credit union has operated with a staff of two and volunteers as available. Last year, the credit union received grant funding enabling it to hire additional staff members—a marketing specialist and member service representative. As a team of four, they work together to provide amazing customer service and outreach to community members. Soon after Rachel became New Covenant Dominion Credit Union’s CEO, the credit union’s leadership applied to be

Soon after Rachel became New Covenant Dominion Credit Union’s CEO, the credit union’s leadership applied to be

‘We Don’t Say No, We Say When’

‘We Don’t Say No, We Say When’ This was especially true during the early waves of the COVID-19 pandemic, when deposits drove up liquidity but falling interest rates meant that financial institutions like Opportunities earned very little interest on that cash. To bolster its margin, the credit union focused on lending areas like

This was especially true during the early waves of the COVID-19 pandemic, when deposits drove up liquidity but falling interest rates meant that financial institutions like Opportunities earned very little interest on that cash. To bolster its margin, the credit union focused on lending areas like  In addition to serving New Americans, Opportunities Credit Union also serves community members who are unhoused and underbanked, including individuals who are struggling with mental health, living in homeless shelters, and/or surviving on social security disability payments. According to Kate, the credit union works at the intersection of mental health and money. Although she acknowledges that she and her team aren’t social workers, Kate said that the credit union is able to “help people whose emotional needs touch their financial needs” through

In addition to serving New Americans, Opportunities Credit Union also serves community members who are unhoused and underbanked, including individuals who are struggling with mental health, living in homeless shelters, and/or surviving on social security disability payments. According to Kate, the credit union works at the intersection of mental health and money. Although she acknowledges that she and her team aren’t social workers, Kate said that the credit union is able to “help people whose emotional needs touch their financial needs” through  Opportunities Abound

Opportunities Abound Additionally, in 2022 alone, Opportunities made 10 staff promotions from within the organization. According to Kate, this has been a win-win for the credit union not only because those employees already know Opportunities’ culture, mission, and systems, but because it’s signaled to entry-level hires and

Additionally, in 2022 alone, Opportunities made 10 staff promotions from within the organization. According to Kate, this has been a win-win for the credit union not only because those employees already know Opportunities’ culture, mission, and systems, but because it’s signaled to entry-level hires and

Another strength of this unique structure is that both First Southwest Bank and First Southwest Community Fund have access to different funding streams that enable them to make loans. For example,

Another strength of this unique structure is that both First Southwest Bank and First Southwest Community Fund have access to different funding streams that enable them to make loans. For example,  HelloBello is Here to Help

HelloBello is Here to Help Kent and Sherry

Kent and Sherry

Given the narrow window of time and the hefty price tag, another CDFI nonprofit —

Given the narrow window of time and the hefty price tag, another CDFI nonprofit — Unfortunately, the mobile home park’s owners rejected the residents’ initial offer. That’s because, according to Kent, First Southwest Bank had to order an appraisal, which became a contingency. Miraculously, within nine days of the rejection, Elevation Community Land Trust was able to bring in

Unfortunately, the mobile home park’s owners rejected the residents’ initial offer. That’s because, according to Kent, First Southwest Bank had to order an appraisal, which became a contingency. Miraculously, within nine days of the rejection, Elevation Community Land Trust was able to bring in  In the end, the residents’ second offer was accepted by the owners, and the co-op officially took over ownership of their land in late April 2022. It took the creativity, agility, and commitment of three different Colorado-based CDFIs to make it happen; but, according to Kent and his team at First Southwest Bank, the experience has been a win-win for everyone involved. There’s little question, however, that the biggest win belongs to the residents of Westside Mobile Home Park. Their success put an end to the inter-generational legacy of displacement experienced by many in their community. Just ask Alejandra Chavez-Alvarez. “The process started and somewhere along the way we lost our fear,” she

In the end, the residents’ second offer was accepted by the owners, and the co-op officially took over ownership of their land in late April 2022. It took the creativity, agility, and commitment of three different Colorado-based CDFIs to make it happen; but, according to Kent and his team at First Southwest Bank, the experience has been a win-win for everyone involved. There’s little question, however, that the biggest win belongs to the residents of Westside Mobile Home Park. Their success put an end to the inter-generational legacy of displacement experienced by many in their community. Just ask Alejandra Chavez-Alvarez. “The process started and somewhere along the way we lost our fear,” she

And while Sandy is grateful for her new car and the reduced rate she received, she is most appreciative that One Detroit Credit Union took the time to look at her whole story.

And while Sandy is grateful for her new car and the reduced rate she received, she is most appreciative that One Detroit Credit Union took the time to look at her whole story.

Unsurprisingly, Wendell and his colleagues have an unmatched desire to shrink the wealth gap in metro Chicago, with an emphasis on the South and West sides of Chicago by giving people in the community the opportunities they need to be successful. For Wendell, that means underwriting deals — deals that traditional lenders won’t touch — that will ultimately benefit both community members and the CDFI. In the past five years, Wendell has underwritten investments at Chicago Community Loan Fund that leveraged more than $443 million in real estate transactions that strengthen lower-wealth communities. “We want to allow wealth to flow,” he said. “When that wealth flows, it opens up more opportunities, because families have more to do more with. At the end of the day, our role is to help create more wealth in these communities — period.”

Unsurprisingly, Wendell and his colleagues have an unmatched desire to shrink the wealth gap in metro Chicago, with an emphasis on the South and West sides of Chicago by giving people in the community the opportunities they need to be successful. For Wendell, that means underwriting deals — deals that traditional lenders won’t touch — that will ultimately benefit both community members and the CDFI. In the past five years, Wendell has underwritten investments at Chicago Community Loan Fund that leveraged more than $443 million in real estate transactions that strengthen lower-wealth communities. “We want to allow wealth to flow,” he said. “When that wealth flows, it opens up more opportunities, because families have more to do more with. At the end of the day, our role is to help create more wealth in these communities — period.”

Learn More

Learn More

And grown it has. According to Charlie, DOF’s first few years were difficult, especially when it came to fundraising; however, the CDFI has been able to grow its total assets from $390,000 in 2008 to $71.4 million in June 2022. Despite not knowing much about the CDFI industry prior to launching their own CDFI, over the past 16 years, Charlie and Nanci have found ways to expand DOF’s portfolio, work, and team in a way that’s demonstrative of the creativity and community-mindedness that’s often associated with the industry.

And grown it has. According to Charlie, DOF’s first few years were difficult, especially when it came to fundraising; however, the CDFI has been able to grow its total assets from $390,000 in 2008 to $71.4 million in June 2022. Despite not knowing much about the CDFI industry prior to launching their own CDFI, over the past 16 years, Charlie and Nanci have found ways to expand DOF’s portfolio, work, and team in a way that’s demonstrative of the creativity and community-mindedness that’s often associated with the industry. DOF saw an opportunity to get involved. At the end of 2018, the CDFI won a federal economic redevelopment grant through the CDFI Fund. When DOF received the money in early 2019, Charlie and his team didn’t have to think hard about where they wanted to focus their efforts. They returned to White Sulphur Springs, met with a delegation that included elected officials, town elders, and local merchants, and, ultimately, purchased a city block. Over the next three years, DOF gut-renovated the buildings, including 16 apartments, and the CDFI invested in enhancements to make sure that the town center would be prepared for the next 1,000-year flood. When the work was completed, the CDFI rented out the residential units at 50% market value and the commercial spaces at $5 a square foot.

DOF saw an opportunity to get involved. At the end of 2018, the CDFI won a federal economic redevelopment grant through the CDFI Fund. When DOF received the money in early 2019, Charlie and his team didn’t have to think hard about where they wanted to focus their efforts. They returned to White Sulphur Springs, met with a delegation that included elected officials, town elders, and local merchants, and, ultimately, purchased a city block. Over the next three years, DOF gut-renovated the buildings, including 16 apartments, and the CDFI invested in enhancements to make sure that the town center would be prepared for the next 1,000-year flood. When the work was completed, the CDFI rented out the residential units at 50% market value and the commercial spaces at $5 a square foot.

For Charlie, the experience was more than enough to get him excited about what other opportunities might exist when CDFIs like DOF and impact-seeking enterprises like Netflix are able to connect through CNote’s custom notes. “That’s the key point of CDFIs doing the work versus a private equity firm doing the work. In looking at community revitalization, PE firms’ first priority is the financial return of a project. CDFIs are asking, ‘what’s going to make sense for this community?’ We can’t give you a 22% return on your investment like PEs, but we are going to give you a 100% return on impact.”

For Charlie, the experience was more than enough to get him excited about what other opportunities might exist when CDFIs like DOF and impact-seeking enterprises like Netflix are able to connect through CNote’s custom notes. “That’s the key point of CDFIs doing the work versus a private equity firm doing the work. In looking at community revitalization, PE firms’ first priority is the financial return of a project. CDFIs are asking, ‘what’s going to make sense for this community?’ We can’t give you a 22% return on your investment like PEs, but we are going to give you a 100% return on impact.”

According to Bill, CADA helped him get into counseling, and after five or six years, he left the nonprofit to pursue opportunities that he never would have had without Dan Talley’s guidance and CADA’s support. However, in 1998, when a management position opened up at CADA, Bill didn’t have to think twice about whether or not to apply. He got the job, returned to CADA, and Dan Talley became his boss. Bill’s been at CADA ever since.

According to Bill, CADA helped him get into counseling, and after five or six years, he left the nonprofit to pursue opportunities that he never would have had without Dan Talley’s guidance and CADA’s support. However, in 1998, when a management position opened up at CADA, Bill didn’t have to think twice about whether or not to apply. He got the job, returned to CADA, and Dan Talley became his boss. Bill’s been at CADA ever since.

That was the case for Susan. According to her, before she was sober, and even early into her recovery, she thought that having a bank account was out of reach. However, thankfully, she was given the opportunity to open an account: a seemingly small accomplishment that helped to propel her forward in her recovery. That’s because, as she described it, having a bank account boosted her self-esteem and made her feel like a human again.

That was the case for Susan. According to her, before she was sober, and even early into her recovery, she thought that having a bank account was out of reach. However, thankfully, she was given the opportunity to open an account: a seemingly small accomplishment that helped to propel her forward in her recovery. That’s because, as she described it, having a bank account boosted her self-esteem and made her feel like a human again. Learn More

Learn More

That’s when a 40-year-old Terri-Nichelle went on a quest to find her purpose — luckily, she didn’t have to travel far. On a popular mountaintop outside of Atlanta, Terri-Nichelle put the question “what am I supposed to be doing?” out into the ether. The answer she received was “look at your life.” Her subsequent reflections took her back to her Minnesotan childhood, where Terri-Nichelle’s mother surrounded her family with Black art and kept Black magazines on the coffee table. Even though she wasn’t necessarily surrounded by neighbors who looked like her, Terri-Nichelle grew up knowing that Black people could be successful. As a child, that knowledge allowed her to dream.

That’s when a 40-year-old Terri-Nichelle went on a quest to find her purpose — luckily, she didn’t have to travel far. On a popular mountaintop outside of Atlanta, Terri-Nichelle put the question “what am I supposed to be doing?” out into the ether. The answer she received was “look at your life.” Her subsequent reflections took her back to her Minnesotan childhood, where Terri-Nichelle’s mother surrounded her family with Black art and kept Black magazines on the coffee table. Even though she wasn’t necessarily surrounded by neighbors who looked like her, Terri-Nichelle grew up knowing that Black people could be successful. As a child, that knowledge allowed her to dream. Terri-Nichelle launched her company as a subscription service in October of 2017. By June the following year, she shut it down. According to her, she didn’t have the requisite business acumen, which meant that Brown Toy Box had been destined to fail fast from the beginning. However, Terri-Nichelle wasn’t discouraged. She’d learned about her customers and the market, and she was willing to give it another shot. “I said to myself, ‘if you’re going to do this, you’re going to do it right,” Terri-Nichelle said. “‘You’re going to have to do the training so that you can be very intentional and purposeful about how you’re going to relaunch this business.’”

Terri-Nichelle launched her company as a subscription service in October of 2017. By June the following year, she shut it down. According to her, she didn’t have the requisite business acumen, which meant that Brown Toy Box had been destined to fail fast from the beginning. However, Terri-Nichelle wasn’t discouraged. She’d learned about her customers and the market, and she was willing to give it another shot. “I said to myself, ‘if you’re going to do this, you’re going to do it right,” Terri-Nichelle said. “‘You’re going to have to do the training so that you can be very intentional and purposeful about how you’re going to relaunch this business.’”

On Target

On Target Terri-Nichelle reached out to ACE, and the CDFI was able to get the toy manufacturer the necessary financing needed to execute the Target deal. Although the larger deal was eventually underwritten by many participating institutions,

Terri-Nichelle reached out to ACE, and the CDFI was able to get the toy manufacturer the necessary financing needed to execute the Target deal. Although the larger deal was eventually underwritten by many participating institutions,

Learn More

Learn More

Kauaʻi is one of the smallest and most remote land masses on earth. In 1992, Hurricane Iniki caused devastating damage to the island. It is in times of great adversity that Kauaʻi and its community shine the brightest. Due to the inability of large groups to meet, Kauaʻi FCU began hosting small pau hana (after hours gatherings) at their newly opened Kilauea branch. The new branch provided a space for community members and leaders to meet, connect and talk about their challenges at a time when everything was shut down. Ivory attended, with a few other community members, and it was then that her interest in community building began to take a sharper focus. For the first time, she learned the distinction between credit unions and banks. The social mission behind credit unions and the way Kauaʻi FCU ʻfeltʻ and was being led, were completely different than any other financial institution she had ever known.

Kauaʻi is one of the smallest and most remote land masses on earth. In 1992, Hurricane Iniki caused devastating damage to the island. It is in times of great adversity that Kauaʻi and its community shine the brightest. Due to the inability of large groups to meet, Kauaʻi FCU began hosting small pau hana (after hours gatherings) at their newly opened Kilauea branch. The new branch provided a space for community members and leaders to meet, connect and talk about their challenges at a time when everything was shut down. Ivory attended, with a few other community members, and it was then that her interest in community building began to take a sharper focus. For the first time, she learned the distinction between credit unions and banks. The social mission behind credit unions and the way Kauaʻi FCU ʻfeltʻ and was being led, were completely different than any other financial institution she had ever known. Starting as a teller, Ivory was able to meet the members and learn the mechanics of the credit union. She began helping Kauaʻi FCU’s Community Development team with rent relief programs including a program with Aloha United Way that no other credit union on Kauaʻi was involved in. In 2021, when it was clear the pandemic was not over, Kauaʻi FCU created a new position, COVID Recovery Program Manager, with a sole focus on creating economic resiliency for Kauaʻi. Ivory jumped into the role with trademark enthusiasm and was able to bring her work as a small business owner, mother and resident of Kauaʻi into full play. “I love bringing people together and I love to connect with them,” she says. “This really translates into the work that I do now, as an advocate for small businesses within the credit union space. I figure out how we can support them (however it may be) as a financial institution.”

Starting as a teller, Ivory was able to meet the members and learn the mechanics of the credit union. She began helping Kauaʻi FCU’s Community Development team with rent relief programs including a program with Aloha United Way that no other credit union on Kauaʻi was involved in. In 2021, when it was clear the pandemic was not over, Kauaʻi FCU created a new position, COVID Recovery Program Manager, with a sole focus on creating economic resiliency for Kauaʻi. Ivory jumped into the role with trademark enthusiasm and was able to bring her work as a small business owner, mother and resident of Kauaʻi into full play. “I love bringing people together and I love to connect with them,” she says. “This really translates into the work that I do now, as an advocate for small businesses within the credit union space. I figure out how we can support them (however it may be) as a financial institution.”

3. Economic Diversification. Like the rest of Hawai’i, Kauaʻi’s economy centers around tourism. When the COVID-19 pandemic grounded planes on the mainland, the island instantly lost its major revenue stream. Once this happened, Ivory says people began to realize that they needed to do things differently, including thinking about their shared economic sustainability. As the owner of a small business that primarily catered to tourists, she herself had to think about how she could pivot her business to be tied more to Kaua’i and less to those visiting it.

3. Economic Diversification. Like the rest of Hawai’i, Kauaʻi’s economy centers around tourism. When the COVID-19 pandemic grounded planes on the mainland, the island instantly lost its major revenue stream. Once this happened, Ivory says people began to realize that they needed to do things differently, including thinking about their shared economic sustainability. As the owner of a small business that primarily catered to tourists, she herself had to think about how she could pivot her business to be tied more to Kaua’i and less to those visiting it.

The Creativity To Say ‘Yes’

The Creativity To Say ‘Yes’

Meda believes so much in the importance of cash flow that its primary

Meda believes so much in the importance of cash flow that its primary  3. Meda views banks as partners. Having spent three decades in banking, Patrick knows that banks aren’t CDFIs’ enemies: banks are regulated. However, even though Meda can be creative to serve its community in flexible ways that banks can’t, the CDFI still works very closely with local financial institutions. Because Meda strives to help its borrowers scale to over $1 million in revenue in less than 36 months, Patrick says that it’s in banks’ best interests to refer customers to

3. Meda views banks as partners. Having spent three decades in banking, Patrick knows that banks aren’t CDFIs’ enemies: banks are regulated. However, even though Meda can be creative to serve its community in flexible ways that banks can’t, the CDFI still works very closely with local financial institutions. Because Meda strives to help its borrowers scale to over $1 million in revenue in less than 36 months, Patrick says that it’s in banks’ best interests to refer customers to

Unsurprisingly, Meda was behind OurPlace Residential Services from the very beginning. The CDFI leveraged its contacts in the real estate community to locate a promising apartment building, and it was unfazed by the $2.5 million price tag to acquire and renovate it. Patrick had trust in his construction background, and Meda is engaging with potential funding partners, like the City of Minneapolis, to position OurPlace Residential Services’ new building for success.

Unsurprisingly, Meda was behind OurPlace Residential Services from the very beginning. The CDFI leveraged its contacts in the real estate community to locate a promising apartment building, and it was unfazed by the $2.5 million price tag to acquire and renovate it. Patrick had trust in his construction background, and Meda is engaging with potential funding partners, like the City of Minneapolis, to position OurPlace Residential Services’ new building for success.

It was about two-and-a-half years after joining Penquis that Lorain ultimately found what she calls her “volunteer job” at

It was about two-and-a-half years after joining Penquis that Lorain ultimately found what she calls her “volunteer job” at

On February 12th, Come Spring made its purchase offer to the building’s owners, and, incredibly, the deal closed on March 31st — 64 days after Lorain and the CSFP Teams initial decision to move the pantry’s location. Meeting the March 31st deadline was significant, Lorain explained, because doing so meant that Come Spring didn’t have to pay taxes on the building for the next year. Therefore, the speed for which The Genesis Fund and the lawyers were able to help Come Spring close on its offer saved the food pantry $3,500. “For us, that’s huge,” Lorain said. “Genesis was amazing to work with. They believed in us from the beginning, and everybody pulled together and made it happen.”

On February 12th, Come Spring made its purchase offer to the building’s owners, and, incredibly, the deal closed on March 31st — 64 days after Lorain and the CSFP Teams initial decision to move the pantry’s location. Meeting the March 31st deadline was significant, Lorain explained, because doing so meant that Come Spring didn’t have to pay taxes on the building for the next year. Therefore, the speed for which The Genesis Fund and the lawyers were able to help Come Spring close on its offer saved the food pantry $3,500. “For us, that’s huge,” Lorain said. “Genesis was amazing to work with. They believed in us from the beginning, and everybody pulled together and made it happen.”

“We encourage people to come and get food basics from us and spend their saved income on gas, heat and to keep their car running so they can get to work and children to school. I don’t want anyone in my community to not know that there are food pantries here where anyone can get food,” Lorain said. “It’s a labor of love, and I love making sure that everybody in western Knox County is fed. It doesn’t get any better than that.”

“We encourage people to come and get food basics from us and spend their saved income on gas, heat and to keep their car running so they can get to work and children to school. I don’t want anyone in my community to not know that there are food pantries here where anyone can get food,” Lorain said. “It’s a labor of love, and I love making sure that everybody in western Knox County is fed. It doesn’t get any better than that.”

Charles is especially excited about Capital for Change’s energy efficiency loans, which help homeowners to conserve energy usage and decrease costs through audits, retrofits, and alternative/clean energy improvements. Charles estimates that on

Charles is especially excited about Capital for Change’s energy efficiency loans, which help homeowners to conserve energy usage and decrease costs through audits, retrofits, and alternative/clean energy improvements. Charles estimates that on

Eventually, Martina returned to her southern roots and moved to Atlanta, where she started to reflect on what she wanted to do long term with her career. She knew she wanted to be on the forefront of working with minority women in business enterprises, but she didn’t know exactly what that might look like. That’s when Martina found herself listening to a panel discussion featuring

Eventually, Martina returned to her southern roots and moved to Atlanta, where she started to reflect on what she wanted to do long term with her career. She knew she wanted to be on the forefront of working with minority women in business enterprises, but she didn’t know exactly what that might look like. That’s when Martina found herself listening to a panel discussion featuring  The Three C’s

The Three C’s

3. Connections. Because ACE knows that many of its clients don’t have a network of other small business owners to rely upon, it strives to

3. Connections. Because ACE knows that many of its clients don’t have a network of other small business owners to rely upon, it strives to

Additionally, just like ACE offers its clients an opportunity to network, Martina says that CNote has helped ACE connect with peer CDFIs across the country who’ve shared best practices, strategies, and ideas that have helped to make ACE more efficient. Similarly, ACE has gained visibility from CNote’s platform, which attracts impact investors, donors, and individuals from localities well beyond Georgia’s borders who want to support women business owners. “I feel like we’re the best kept secret, but we don’t want to be the best kept secret,” Martina said. “That’s why CNote is such an instrumental partner for us beyond capital, because CNote can talk about us in rooms that we don’t necessarily get access to.”

Additionally, just like ACE offers its clients an opportunity to network, Martina says that CNote has helped ACE connect with peer CDFIs across the country who’ve shared best practices, strategies, and ideas that have helped to make ACE more efficient. Similarly, ACE has gained visibility from CNote’s platform, which attracts impact investors, donors, and individuals from localities well beyond Georgia’s borders who want to support women business owners. “I feel like we’re the best kept secret, but we don’t want to be the best kept secret,” Martina said. “That’s why CNote is such an instrumental partner for us beyond capital, because CNote can talk about us in rooms that we don’t necessarily get access to.”

To help educate community members that they don’t have to be employed by a school to join the credit union, in 2020, ECU decided to pair its decades-old brand recognition with a new tagline: “Learn More, Live More ®.” According to Eric Jenkins, ECU’s CEO, those words say it all. “We’re staying true to our scholastic roots, because we wouldn’t exist without the educators who founded us,” he said, “but the ‘education’ part of our name is we are striving to teach consumers financial responsibility and wellness so that they can live more.”

To help educate community members that they don’t have to be employed by a school to join the credit union, in 2020, ECU decided to pair its decades-old brand recognition with a new tagline: “Learn More, Live More ®.” According to Eric Jenkins, ECU’s CEO, those words say it all. “We’re staying true to our scholastic roots, because we wouldn’t exist without the educators who founded us,” he said, “but the ‘education’ part of our name is we are striving to teach consumers financial responsibility and wellness so that they can live more.”

3. BUFF $MART Program: In partnership with West Texas A&M University (whose mascot is a buffalo), ECU launched a financial literacy boot camp designed for college students. Since 2018, more than 300 students have gone through

3. BUFF $MART Program: In partnership with West Texas A&M University (whose mascot is a buffalo), ECU launched a financial literacy boot camp designed for college students. Since 2018, more than 300 students have gone through

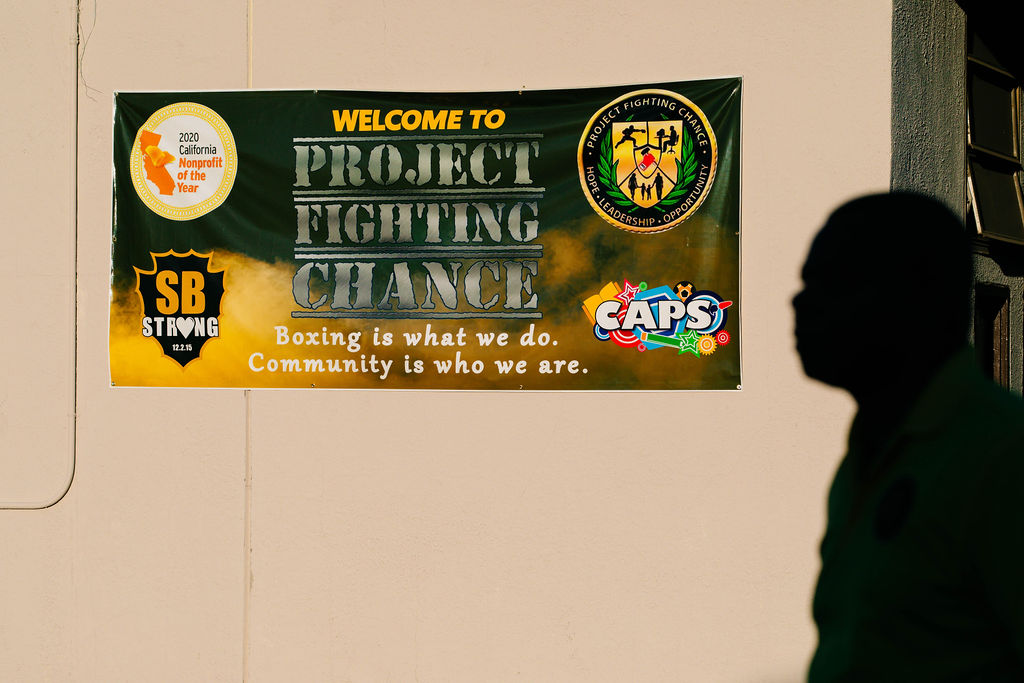

Since its inception, Project Fighting Chance has built itself a championship reputation within the national amateur boxing community. For example, in 2018,

Since its inception, Project Fighting Chance has built itself a championship reputation within the national amateur boxing community. For example, in 2018,

Going Toe-to-Toe With A Global Pandemic

Going Toe-to-Toe With A Global Pandemic Thanks to Self-Help, Project Fighting Chance applied for and received two rounds of PPP loans, which meant that the nonprofit did not have to lay off any of its six employees. The PPP funding also kept fuel in Project Fighting Chance’s tanks — literally. For the first 18 months of the pandemic, the nonprofit used its two vans to deliver 170 meals every day to youth around San Bernardino, ensuring that those experiencing food and transportation insecurity at home could still be served. “The PPP funding proved critical, because it allowed us to repurpose the organization to support young people and their parents in the community,” Terry said. “We were the place they could count on every day, and we basically got those funds and invested them into the community to make sure that we could stay available to these youth.”

Thanks to Self-Help, Project Fighting Chance applied for and received two rounds of PPP loans, which meant that the nonprofit did not have to lay off any of its six employees. The PPP funding also kept fuel in Project Fighting Chance’s tanks — literally. For the first 18 months of the pandemic, the nonprofit used its two vans to deliver 170 meals every day to youth around San Bernardino, ensuring that those experiencing food and transportation insecurity at home could still be served. “The PPP funding proved critical, because it allowed us to repurpose the organization to support young people and their parents in the community,” Terry said. “We were the place they could count on every day, and we basically got those funds and invested them into the community to make sure that we could stay available to these youth.”

Whether it’s local council members, California state assembly members, school district administrators, teachers, mentors, counselors, therapists, coaches, parents, or credit unions like Self-Help, Terry is quick to acknowledge the broad

Whether it’s local council members, California state assembly members, school district administrators, teachers, mentors, counselors, therapists, coaches, parents, or credit unions like Self-Help, Terry is quick to acknowledge the broad

What Mellaney wants for her business’ future is to expand into other cities, to grow its operations, and to bring as much of its supply chain as possible in house. Her ultimate goal, however, is to franchise American Home and Commercial Services and to one day go public. She’s a vocal promoter of

What Mellaney wants for her business’ future is to expand into other cities, to grow its operations, and to bring as much of its supply chain as possible in house. Her ultimate goal, however, is to franchise American Home and Commercial Services and to one day go public. She’s a vocal promoter of

Full Steam Ahead

Full Steam Ahead Given where she was and what she was doing five years ago, it may seem unbelievable what Danielle is doing today as the founder and CEO of Topsail Steamer; but, for Danielle, something like this was always in the cards for her. She grew up watching her father, who happened to be a small business owner himself, and according to her, one of her strengths has always been to identify opportunities around her. In the case of Topsail Steamer, while it’s been a blend of opportunity, timing, and serendipity that has contributed to its success, the business’ skyrocketing trajectory is in large part a result of Danielle having faith in herself. Unsurprisingly, when asked what advice she has for other late-in-life entrepreneurs, it’s the same advice that she’s told herself time and time again: “just have confidence in yourself.”

Given where she was and what she was doing five years ago, it may seem unbelievable what Danielle is doing today as the founder and CEO of Topsail Steamer; but, for Danielle, something like this was always in the cards for her. She grew up watching her father, who happened to be a small business owner himself, and according to her, one of her strengths has always been to identify opportunities around her. In the case of Topsail Steamer, while it’s been a blend of opportunity, timing, and serendipity that has contributed to its success, the business’ skyrocketing trajectory is in large part a result of Danielle having faith in herself. Unsurprisingly, when asked what advice she has for other late-in-life entrepreneurs, it’s the same advice that she’s told herself time and time again: “just have confidence in yourself.”

Even before the pandemic sent the U.S. into a lockdown in March 2020, entrepreneurs around the country feared that their small businesses wouldn’t be able to survive an economic shutdown. However, when

Even before the pandemic sent the U.S. into a lockdown in March 2020, entrepreneurs around the country feared that their small businesses wouldn’t be able to survive an economic shutdown. However, when

While hundreds of credit unions and CDFIs like TruFund were able to play their part as

While hundreds of credit unions and CDFIs like TruFund were able to play their part as  ‘We’re Gonna Need A Bigger Boat’

‘We’re Gonna Need A Bigger Boat’ That, and the desperation he could so clearly hear in Self Help’s clients’ voices. Not only were people’s livelihoods on the line, but for nonprofits and social enterprises dedicated to serving communities, the PPP loan applications were about more than paying employees: they were about keeping things like youth programs running, health clinics operational, and food banks open. “If someone called me at 8:30 pm while I was at a football game with my son, I was gonna take it,” Jim said. “You can’t take care of everybody, but at the end of the day, if you take care of the people that are taking care of the people, then people will be taken care of. That’s what Self-Help does.”

That, and the desperation he could so clearly hear in Self Help’s clients’ voices. Not only were people’s livelihoods on the line, but for nonprofits and social enterprises dedicated to serving communities, the PPP loan applications were about more than paying employees: they were about keeping things like youth programs running, health clinics operational, and food banks open. “If someone called me at 8:30 pm while I was at a football game with my son, I was gonna take it,” Jim said. “You can’t take care of everybody, but at the end of the day, if you take care of the people that are taking care of the people, then people will be taken care of. That’s what Self-Help does.” Perhaps not surprisingly, Jim won’t be returning to his life of semi-retirement anytime soon — he signed on full-time with Self-Help in July of 2021. According to him, he fell in love with the credit union’s focus on minority-owned businesses, nonprofits, and other enterprises that traditional banks typically don’t consider, and he’s already feeling like he’s making a difference. “You go home every night feeling like you did some good,” Jim said. “I haven’t felt this good in my 30-something years in banking, where my stress is a blessing because I get to come back tomorrow and ask ‘how do we do more?’ At Self-Help, that really is the goal every day.”

Perhaps not surprisingly, Jim won’t be returning to his life of semi-retirement anytime soon — he signed on full-time with Self-Help in July of 2021. According to him, he fell in love with the credit union’s focus on minority-owned businesses, nonprofits, and other enterprises that traditional banks typically don’t consider, and he’s already feeling like he’s making a difference. “You go home every night feeling like you did some good,” Jim said. “I haven’t felt this good in my 30-something years in banking, where my stress is a blessing because I get to come back tomorrow and ask ‘how do we do more?’ At Self-Help, that really is the goal every day.”

Deshonda received her law degree from Tulane University in 2003 and went on to pass four different Bar Exams in four states: Louisiana, Connecticut, New York, and Texas. Deshonda landed a position in a small boutique law firm in Houston, Texas after graduating and for just under six years she thrived at networking and promoting her services. Deshonda’s knack for generating business was recognized by the firm’s managing partner, and her mentor, who occasionally asked whether she’d ever considered starting her own practice. According to Deshonda, not only was he a wonderful mentor to her, but when she decided to initiate a conversation with him about going her own way six years after joining the firm, he told her that she had his full support. More so, he approved of her taking all of her current clients with her.

Deshonda received her law degree from Tulane University in 2003 and went on to pass four different Bar Exams in four states: Louisiana, Connecticut, New York, and Texas. Deshonda landed a position in a small boutique law firm in Houston, Texas after graduating and for just under six years she thrived at networking and promoting her services. Deshonda’s knack for generating business was recognized by the firm’s managing partner, and her mentor, who occasionally asked whether she’d ever considered starting her own practice. According to Deshonda, not only was he a wonderful mentor to her, but when she decided to initiate a conversation with him about going her own way six years after joining the firm, he told her that she had his full support. More so, he approved of her taking all of her current clients with her. Do Better Business

Do Better Business Yet another challenge presented itself to Deshonda when she attempted to secure PPP funding for TTF. She went to the only big bank where she’s ever done business to inquire about resources, guidance, and PPP eligibility. According to her, she might as well have walked into the room and thrown spaghetti on the walls. “They just didn’t care,” she said. “I couldn’t get a banker to even acknowledge that I had submitted the application because I wasn’t a big enough fish.” Frustrated, Deshonda turned to the support group of like-minded minority women business owners that she’s a part of in Houston. That’s when one of her good friends referred her to