We’re excited to announce that CNote investors helped to create/maintain over 400 jobs in Q2 of 2021.

In this report you’ll see:

- An update from CNote’s Head of Community Development Director

- CNote’s Q2 impact metrics

- Three new CNote impact stories

- A CNote firm and portfolio update

Since Inception, CNote has created or maintained 5,232 Jobs

In Quarter Two of 2021, CNote Deployed: 71% of Dollars to BIPOC-Owned Businesses

From the time that Dr. Alexia McClerkin broke her ankle in high school, she knew she wanted to become a doctor. She chose to study kinesiology so that she could work with athletes, allowing them to get better and to return to their sports. That passion led Alexia to become a registered nurse and study chiropractic medicine.

In June 2016, she started her own private practice- The Beauty and Wellness Doc, which offers a variety of traditional services, including adjustments, deep tissue massage, stretching, dry needling, athlete recovery, therapeutic laser, and cupping.

When Alexia initially looked to furnish her new space with equipment and furniture, she met with a lender who told her that they would give her a loan that wouldn’t affect her credit. After reading the fine print, however, Alexia discovered that the interest rate was 65% and that she would have to pay an exorbitant loan origination fee.

Fortunately, Alexia already had a long-standing relationship with CNote CDFI partner, Trufund, who was able to help Alexia to navigate the second round of PPP funding. Today, business at The Beauty and Wellness Doc is booming. According to Alexia, the pandemic, in a way, has turned out to be good for her business, as the pivot to remote working has left a lot of people with low back, shoulder, and neck pain caused by poor ergonomics and bad workspaces at home.

In Quarter Two of 2021, CNote Deployed: 43% of Dollars to Women-Led Businesses

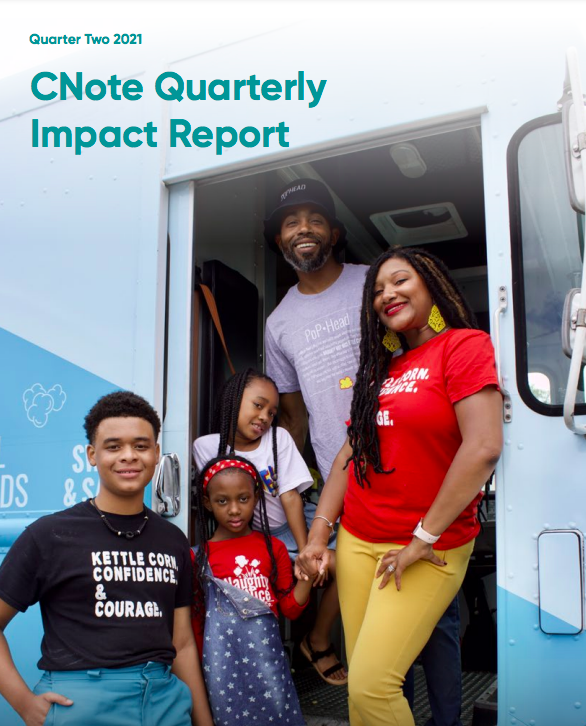

Tanesha Sims-Summers is the founder of Naughty But Nice Kettle Corn Co., a gourmet, hand-popped kettle corn company based out of Birmingham, Alabama.

While Tanesha credits the success of her company with having a quality (and addictive) product, she notes that seizing every opportunity to educate herself as an entrepreneur has equally fueled her company’s growth. That thirst for education is what led her to connect with TruFund, a CNote partner and Community Development Financial Institution (CDFI).

Tanesha has taken advantage of a number of TruFund’s programmatic offerings, and through the CDFI, she’s connected with and learned from fellow entrepreneurs. Additionally, in 2019 TruFund provided Tanesha with a $50,000 loan to complete the build-out of Naughty But Nice Kettle Corn Co.’s food truck — Miss Poppy — and to provide some extra cushion for miscellaneous expenses.

In Q2 of 2021, CNote deployed 38% of Dollars to Low-and Moderate-Income Communities

Those dollars ended up supporting individuals like Tawnya Sanford who had opened an in-home daycare center so that she could spend more time with her daughter. Years later, when Tawnya was looking to expand to a larger daycare center, she was put in touch with the owners of The Little Engine Learning Center. But when the time came to purchase the business, Tawnya ran into a problem: finding a bank that would give her a loan.

“Every time I’d call a bank about a loan, they’d tell me ‘no,’” Tawnya said. “They told me I needed to have between $80,000 and $100,000 before they’d even talk to me. It was very depressing.”

Fortunately, Tawnya was able to connect with LiftFund, a CNote partner and San Antonio-based Community Development Financial Institution (CDFI), who was able to provide a 401(k)-backed loan that allowed her to purchase the business portion of the Little Engine Learning Center.

CNote Partner Profile: LiftFund

Portfolio: CNote Flagship Fund

About: CNote continues to profile our CDFI partners to highlight the incredible work they have done and continue to do for their local communities. These profiles will discuss their focus area, the geographies they serve, and a specific impact story that exemplifies the work they do.

Thousands of financially underserved small businesses and entrepreneurs are denied capital daily and need to rely on predatory lenders that cost more than they can afford. According to data released by the Federal Reserve in 2020, while 80.2% of White business owners received at least a percentage of the funding they requested from a bank, that figure was only 60.9% for Black business owners and 69.5% for Hispanic business owners.

LiftFund, a CDFI loan fund, was founded in 1994 in San Antonio, Texas, to level the financial playing field for the financially underserved entrepreneur with the goal of self-sufficiency and success for all those seeking it. LiftFund believes everyone deserves the opportunity to build a company successfully with capital no matter their background, race, ethnicity, sexual identity, or geography.

In 2020 alone, LiftFund equipped 4,500 small businesses with $98.2 million in relief funding in the form of small business loans, forgivable loans, grants, loan payment relief, and PPP, primarily to low to moderate-income, BIPOC communities. But capital is only one piece of the puzzle for small business success. That’s why LiftFund also provided over 7,000 hours of business support in topics like credit review, startup assistance, financial education, and more. These dollars and business support hours help entrepreneurs like Montina Young, Founder of CIA Media Group, an award-winning digital marketing agency helping companies rethink business for the digital age. Even though business was booming for Montina, she often did not receive payment for her services for 30, 60, or sometimes even 90 days after the project was completed. She connected with LiftFund who provided Montina with funding to have sufficient payroll on hand, purchase video production equipment, and repay debt.

LiftFund was also able to provide technical assistance to Montina, teaching her how to read her cash flow statement, profit and loss statement, and balance sheets. Montina has also taken advantage of the professional gathering opportunities offered by LiftFund, which she says are especially important for BIPOC and women entrepreneurs, who don’t often have mentors or family members who’ve owned and operated a successful business.

CNote Firm Update

At CNote, our north star is to close the wealth gap by driving investments and deposits into institutions that are generating long-term positive change for financially underserved communities.

That is why we were thrilled when PayPal announced that it would deposit $135M into mission-driven financial institutions, including depository institutions, through CNote’s Impact Cash™ Program. PayPal also committed to investing in wealth creation opportunities for BIPOC women by investing in CNote’s Wisdom Fund.

In April, CNote celebrated its five-year anniversary. In those five years, we have continued to innovate to best meet the needs of our partners and the communities that they serve. That’s why in response to requests from investors who wanted to support specific geographies and demographics, CNote created a new customization service that allows corporate treasury departments to invest in specific CDFIs that help them meet diversity, equity, and inclusion goals and improve their performance on ESG measures.

Finally, over the last quarter, CNote was featured in publications like Sustainable Brands, Green Money, Green Biz, and NASDAQ. These articles covered topics like democratizing capital, how treasurers can lead their company’s impact investing efforts, and roadmaps for a more equitable future. By continuing to be a thought leader in the space and driving capital towards community needs across the U.S, CNote continues to contribute to a more equal future.

CNote Portfolio Update

CNote’s portfolio of CDFI Loan Funds continues to demonstrate solid performance and financial stability. Across several weighted average indicators, the portfolio saw minimal changes. Specifically, net assets to total assets saw a slight decline from 29.8% to 29.3%. While delinquency levels did decrease, charge-off levels saw a slight increase from the prior quarter, though staying well below 1% and lower than the historical charge-off levels, including the past 12 months. Overall, the portfolio indicators are comparable or better than the same indicators a year ago.

CNote Portfolio Update

Taken together, these indicators are consistent with a portfolio, like the CDFI industry writ large, that continues to engage in either pandemic-responsive or business-restart lending in a responsible manner; CDFIs are investing built-up cash, reserves, and net assets from prior quarters strategically to respond to the needs of its respective client base as the various local, state, and federal resources have begun to wind down or have sunset. This also includes several CDFIs continuing sustained PPP lending through May 31, 2021, originally extended from the March 31, 2021 program deadline.

In the prior quarter lending summary, CNote mentioned the imminent boost to 863 CDFIs through the Rapid Response Program, a $1.25B supplemental appropriation for the fund to provide grants to CDFIs to support, prepare for, and respond to the economic impact of the COVID-19 pandemic. All CNote’s current portfolio borrowers were awardees of this program, with most receiving the maximum allocation. Several portfolio borrowers report having received or an expectation to receive these funds in the near-term.

Letter from CNote’s Community Development Director

Uneven economic recovery from COVID-19 will be an enduring issue in the US. Employment rates for high-wage workers have already surpassed pre-covid levels, yet job losses continue for low-wage workers. As of May 15th, employment rates for high-wage workers had risen by nearly 9%, while they had decreased by over 20% for low-wage workers.

We partner and deploy capital exclusively to financial institutions whose mission is to support and financially empower underserved communities. These are the communities with low-wage workers whose struggles are far from over. As CNote’s Community Development Director, I listen closely to these partners to ensure that we understand their challenges so we can continue to best serve them and the communities they work with.

In support of these efforts, CNote authored a Spring 2021 Capital Needs Survey, the first report in a bi-annual series designed to help investors understand the capital needs of CDFIs and ongoing investment gaps that most efficiently address community needs.

The survey showed that 65% of surveyed CDFIs noted an increase in their capital demands over the last year. An additional 75% of surveyed loan funds expressed an “urgent or somewhat urgent need for capital over the next 6-12 months.”

Thankfully, Congress addressed the pressing need for capital with its appropriation of $204.5 million to the CDFI Fund. These awards are being distributed to CDFIs across the country and support programming related to technical assistance, persistent poverty financial assistance, disability funds financial assistance, and healthy food financing in low-income and financially underserved communities.

While these awards are critical in creating meaningful impact, it’s worth noting that the aggregate request from CDFIs from across the country totaled $565.3 million, highlighting the opportunity for impact investors to affect tremendous positive change in communities.

Every dollar invested or deposited with our community-first partners works towards reducing the wealth gap through affordable housing construction, connecting entrepreneurs with learning resources, and capitalizing small-business expansion. Combined, these activities create community development, economic empowerment, and wealth creation for communities that are still struggling to make a full recovery from COVID.

At CNote, we have never been more proud to partner with and support our CDFI and community partners. If you have any questions about CNote, our impact, or how you can work with us, please contact me at Stacy@mycnote.com.

Thank you for Reading

Stacy Zielinski

CNote’s Community Development Director