There is a frightening issue for many community-minded financial institutions across the country and the under-resourced communities they serve: a lack of deposits at their local banks and credit unions.

Depository institutions like banks and credit unions take in funds—called deposits—from those with money, pool them, and lend them to those who need funds in the form of loans. Communities across the United States rely on deposits at their local bank or credit union to support their small businesses, cover emergency expenses, consolidate their debt, and pay for housing, schooling, car payments, and more.

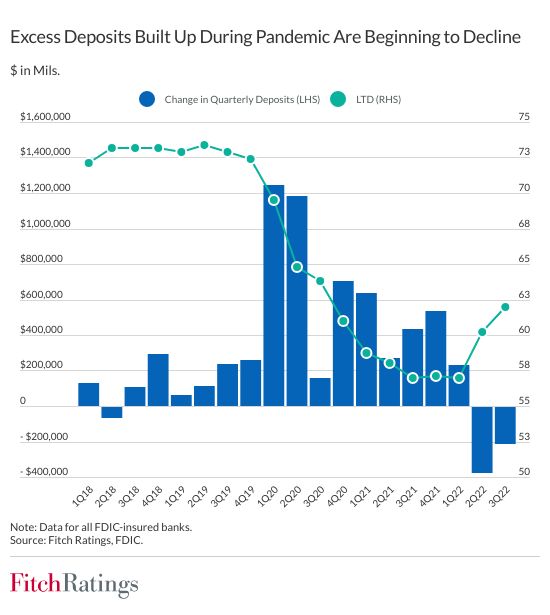

During COVID, deposit levels skyrocketed. But that all changed in the second quarter of 2022, where deposits at FDIC-insured banks fell $370 billion; the first quarterly drop in four years.

A report from Fitch in January of 2023 explained that they would expect to see bank deposits “shrink meaningfully through 2024, as “depositors seek higher-yielding alternatives for non-operating cash”, and “the Fed continues to shrink its balance sheet through quantitative tightening.”

Fitch expects U.S. banking industry deposits, which stood at $19.4 trillion at Sept. 30, 2022, to decline by $1.6 trillion in 2023 and a further $1.4 trillion in 2024

So what changed? And what are the implications of fewer available deposits?

In 1998, in a report from the Federal Reserve Bank of Minneapolis, John Franklin, president of First United Bank, gave a prescient warning. He was concerned that even though a decline in deposits would not lead to a reduced loan supply for most borrowers, “The next crisis in community banking, without a correction in the stock market, will be the lack of funds necessary for community banks to lend to Main Street and to farmers.”

Additionally, Fitch’s report notes that banks with “stronger core deposit franchises will be less vulnerable to liquidity changes.” However, depository institutions could face liquidity challenges if they are “experiencing elevated loan growth at the same time deposits decline.”

And that is exactly what is happening to financial institutions like low-to-moderate-income focused banks and credit unions. Deposit levels are dropping as these institutions are stepping up to serve the communities who need it most.

According to Cornerstone Advisors’ eighth annual “What’s Going On in Banking” report, “Seventy percent of credit unions named growing retail deposits as a high priority in 2023 – nearly four times the 18% that said so in 2022.”

On the consumer side, take this NYT’s article which explains that while higher-income households built up savings and wealth during the pandemic, lower-income households “are struggling more profoundly with inflation.”

Assistance groups that provide food, rental assistance, and other forms of aid to in-need communities have seen more requests for help in recent months “as local families fall behind on their bills. The size of the typical request has gone up too, from a few hundred dollars to a few thousand.”

Individuals and corporations seeking to create an impact have realized that one of the surest ways to do so is to use cash as a tool to support under-resourced communities.

At CNote, we help corporations move fully-insured cash allocations to depository institutions to support impactful loan activity in under-resourced communities across the country. These deposits have helped individuals like Catherine Dorsey escape vicious predatory lenders and save thousands of dollars over the life of her loan.

They’ve also helped entrepreneurs like Mellaney Williams survive, and grow, during COVID

It’s important to remember that deposit levels are predicted to drop even further over the next two years, placing more stress on under-resourced communities and the depository institutions that serve them. As a result, cash allocations to community financial depository institutions are rapidly becoming one of the surest ways to create a transformational impact.

Learn More:

- Learn more about CNote and our cash management solution, Impact Cash ®.

- View and download a copy of the infographic

- Contact us at Hello@mycnote.com