What is Impact Cash®?

Make a difference with your cash deposits.

Impact Cash® is a 100% FDIC/NCUA-insured cash management solution designed for corporations, foundations, and individuals. Every dollar you deposit remains fully insured, providing you with security and peace of mind while contributing to a positive impact in underserved communities.

A More Impactful

Cash Management Solution

Available to Individuals, Corporations, and Foundations

Accessible to individual investors with a minimum investment of $1,000,000, as well as corporations and foundations.100% FDIC and NCUA Insured

Designed to be 100% insured via FDIC and NCUA programs, providing positive social impact with the peace of mind that deposits are backed by the full faith and credit of the United States government.

Flexible Liquidity

Funds are available on demand, subject to potential early withdrawal penalties assessed by our community partners.

Scalable

CNote only partners with mission-driven financial institutions which regularly report on the community development activity they’re achieving.

Impact

CNote partners only with mission-driven financial institutions. CNote reports regularly on the change Impact Cash® holders are achieving.

Ease of Use

Access multiple mission-driven financial institutions with a single account, all online.

See How Much Interest You Could Earn

*Information provided for illustrative comparison only; not an offer to buy or sell any cash product. National 3-month CD and savings rates are from FDIC Monthly Rate (https://www.fdic.gov/national-rates-and-rate-caps) data as of December 15, 2025. Impact Cash rate as of December 15, 2025. All rates are set by financial institutions, subject to change, and may depend on deposit requirements. CNote Group, Inc. is not a bank, credit union, or financial institution. Impact Cash deposits are not securities or investments.

CNote is a

Trusted Partner

“With the expertise, technology, and vision to align corporate cash with meaningful social impact. By addressing the U.S. wealth gap, CNote empowers underrepresented businesses and entrepreneurs in underserved areas, driving sustainable change and economic growth.”

— Jeffrey Whitford, Vice President, Sustainability & Social Business Innovation

Life Science | Strategy & Transformation, A business of Merck KGaA, Darmstadt, Germany

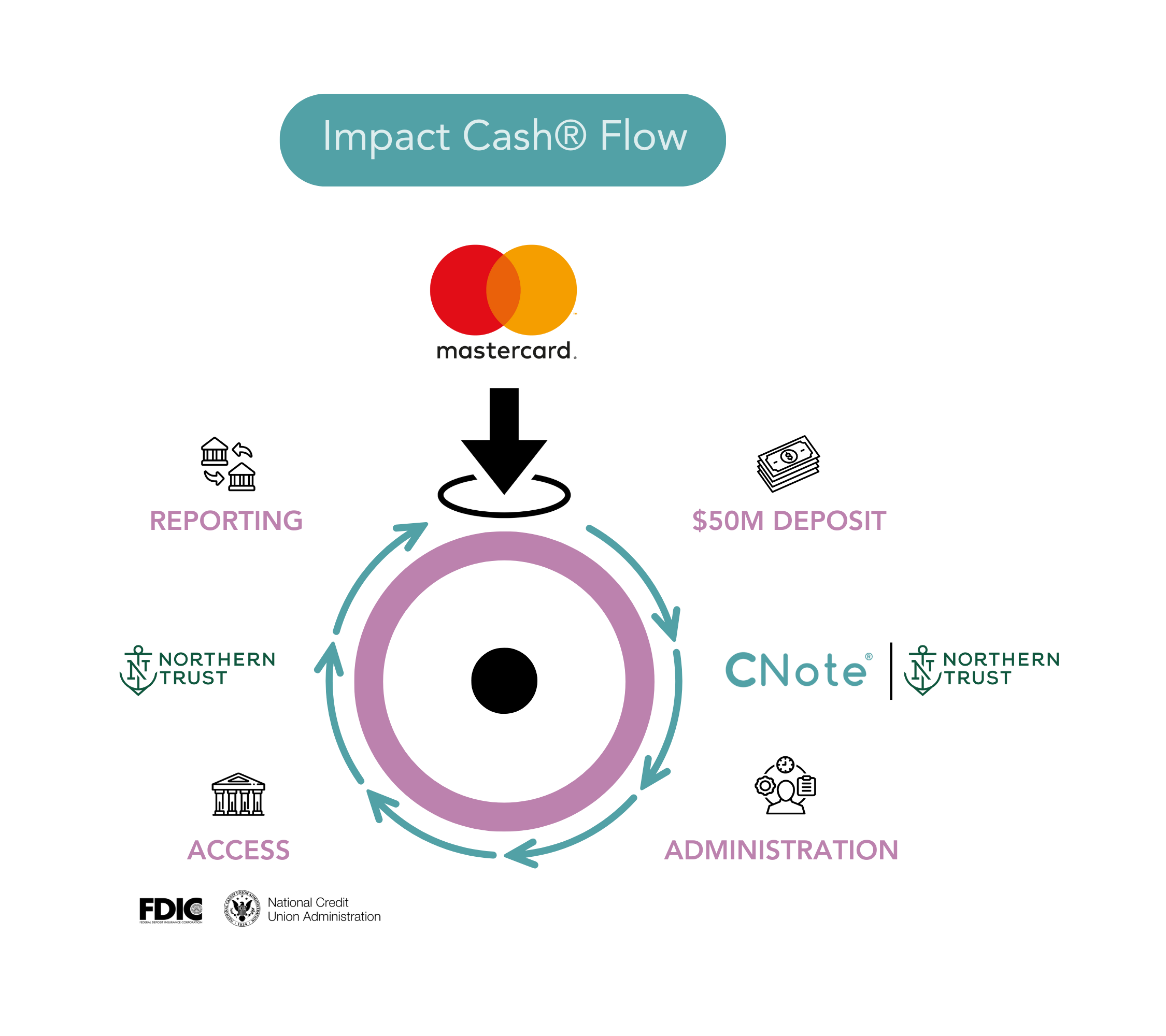

The Impact Cash® Flow

Impact Cash® takes your deposits and turns them into a force for good. With 100% FDIC/NCUA insurance, your funds are securely placed into mission-driven financial institutions, such as CDFI banks and credit unions, handpicked to align with your impact goals, geographic preferences, and organizational needs.

Through a seamless custodian partnership with Northern Trust, CNote deploys your dollars toward mission-driven financial institutions focused on initiatives that matter—affordable housing, small business growth, racial equity, disaster recovery, and climate resilience—directly strengthening communities.

But the impact doesn’t stop there. You’ll receive updates with detailed metrics and inspiring stories, showing exactly how your deposits are driving positive change. With CNote, you’re not just safeguarding your funds; you’re making a tangible difference in the world.

Why Choose

Impact Cash®?

![]() Peace of Mind: Fully insured deposits (100% FDIC/NCUA) ensure your funds are protected.

Peace of Mind: Fully insured deposits (100% FDIC/NCUA) ensure your funds are protected.

![]() Competitive Market Returns: Earn a blended return while aligning your cash with your values.

Competitive Market Returns: Earn a blended return while aligning your cash with your values.

![]() Direct Impact: Support the causes you care about, from environmental sustainability to economic empowerment.

Direct Impact: Support the causes you care about, from environmental sustainability to economic empowerment.

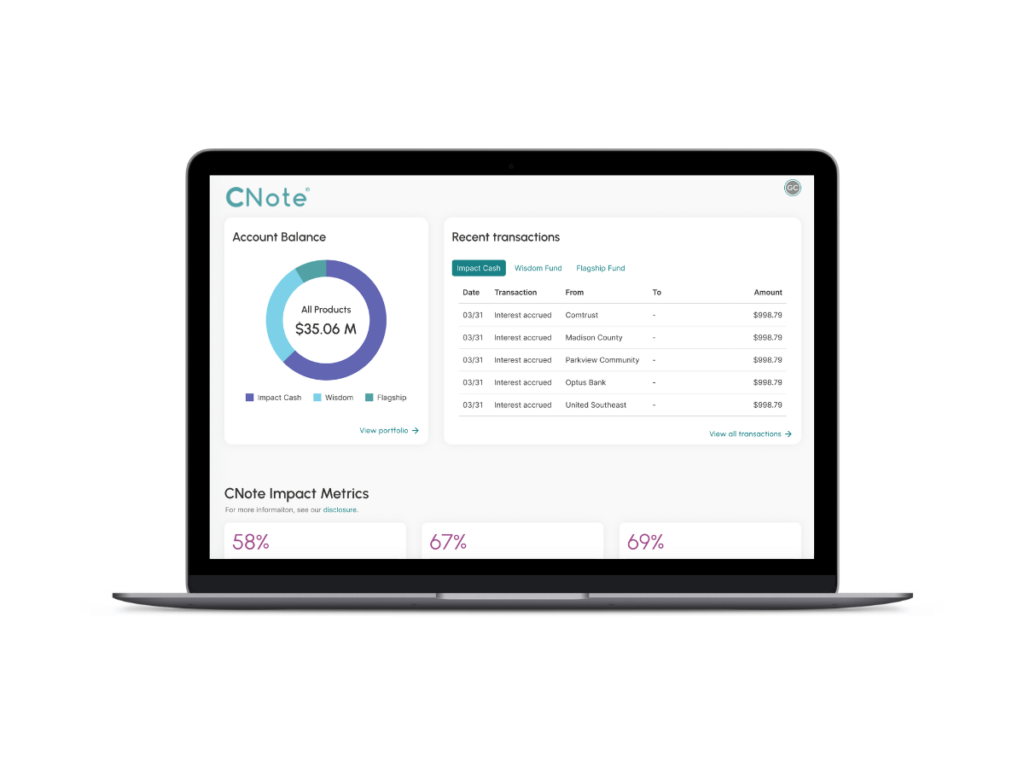

![]() Effortless Management: An easy-to-use online portal simplifies funds management, so you can focus on what matters most.

Effortless Management: An easy-to-use online portal simplifies funds management, so you can focus on what matters most.

Your Money, Your Impact

Since January 2023, CNote’s Partner Institutions have Originated:

Illustrative Impact Cash® Beneficiaries.

Where your cash deposits can make a difference. CNote actively shares and reports the impact your dollars are making allowing you to keep up to date on how your cash deposits are making a difference. Stories featured on CNote’s blogs are stories shared and reporting by our financial partners

As corporate treasury teams navigate the complexities of 2026, a significant shift is occurring in how organizations manage liquidity. While previous years focused on consolidating banking relationships for the sake of simplicity, modern treasury leaders are now prioritizing diversification without disruption. This approach allows for a broader distribution of capital without increasing the administrative burden […]

In a financial landscape where headlines often highlight market volatility, corporate treasurers are increasingly focused on the core fundamentals of capital preservation and security. While size is often equated with safety, stability is more often a product of discipline, transparency, and local integration. At CNote, we work with a vetted network of community-driven financial institutions, […]

When markets turn volatile, we’ve seen a similar cash management playbook: Pull back.Consolidate cash.Lean harder on the biggest banks. It feels like the responsible thing to do. Big logos, long histories, familiar names, all of it signals “safe” when the headlines are noisy. At the same time, anything labelled impact often gets mentally filed under […]

When treasury teams talk about cash, the focus is usually clear:safety, liquidity, yield. But there’s another, quieter story playing out in the background. Across the U.S., community banks and credit unions are using deposits to support financing affordable housing, small business growth, and neighborhood revitalization often in places traditional finance overlooks. Community-driven deposit administration platforms, […]

Partners

By working with some of the country’s most inspiring and dedicated leaders, Impact Cash® drives capital and new opportunities into the hands of underserved communities across the United States. CNote partners are committed to co-creating the product alongside the community we aim to serve.