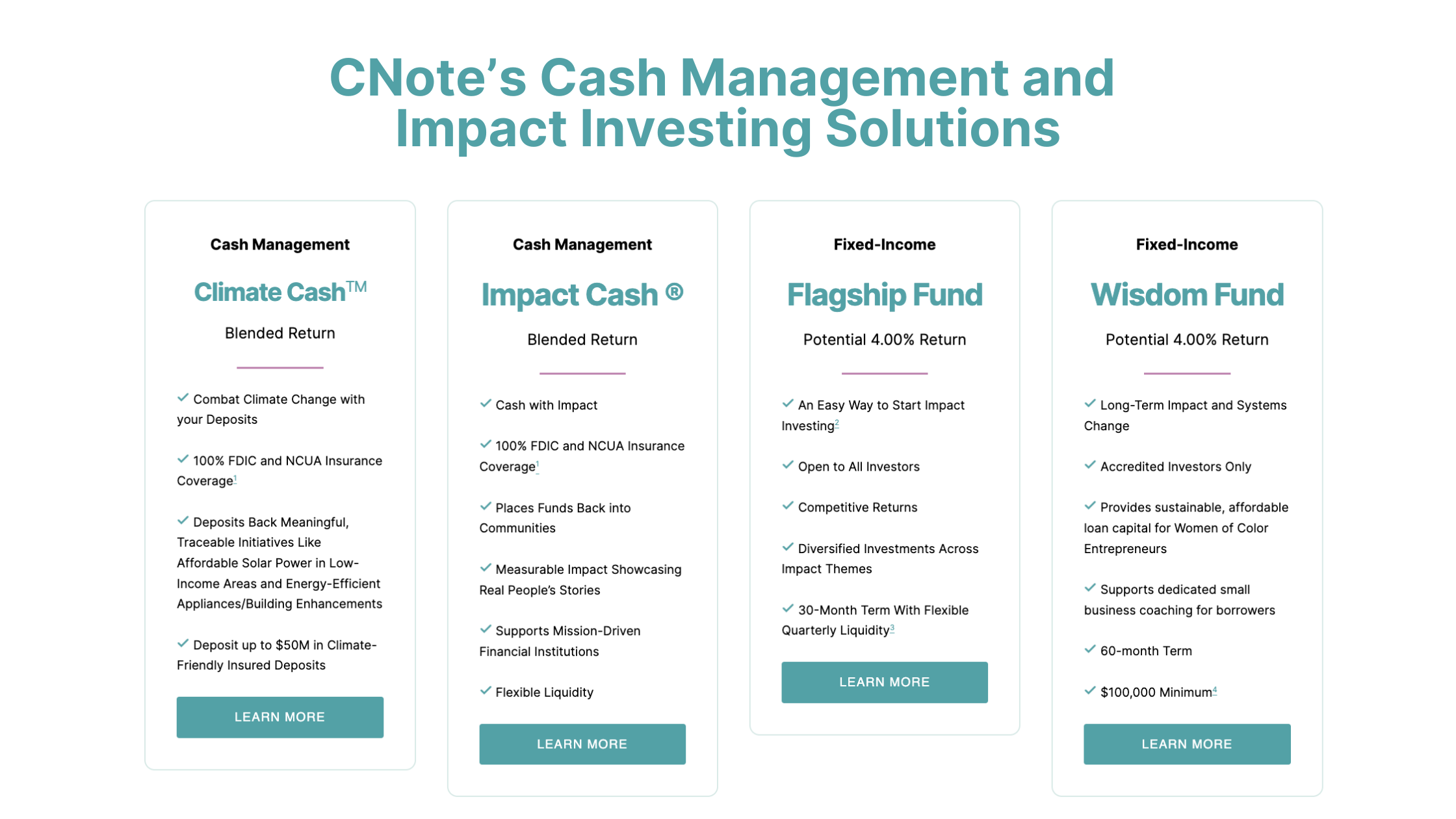

CNote’s Core Offerings

CNote offers a new way to put your cash to work—designed to deliver competitive financial returns while maximizing impact through innovative financial solutions. With our technology, we have created impact investing solutions that cater to businesses, institutions, and individual investors looking to grow their capital. With 100% FDIC and NCUA-insured cash management options, and fixed-income offerings, CNote delivers flexibility, diversification, and steady growth potential, all while channelling financial support to underserved communities.

Cash Management

Climate CashTM

Blended Return

![]() Combat Climate Change with Your Deposits

Combat Climate Change with Your Deposits![]() 100% FDIC and NCUA Insurance Coverage1

100% FDIC and NCUA Insurance Coverage1![]() Deposits Back Meaningful, Traceable Initiatives Like Affordable Solar Power in Low-Income Areas and Energy-Efficient Appliances/Building Enhancements

Deposits Back Meaningful, Traceable Initiatives Like Affordable Solar Power in Low-Income Areas and Energy-Efficient Appliances/Building Enhancements![]() Deposit up to $50M in Climate-Friendly Insured Deposits

Deposit up to $50M in Climate-Friendly Insured Deposits

![]() Institutional Investors Only

Institutional Investors Only

Cash Management

Impact Cash ®

Blended Return

![]() Supports Underserved Communities Throughout America

Supports Underserved Communities Throughout America![]() 100% FDIC and NCUA Insurance Coverage2

100% FDIC and NCUA Insurance Coverage2

![]() Measurable Impact Showcasing Real People’s Stories

Measurable Impact Showcasing Real People’s Stories ![]() Supports Mission-Driven Financial Institutions

Supports Mission-Driven Financial Institutions ![]() Flexible Liquidity

Flexible Liquidity

![]() Accredited Investors Only

Accredited Investors Only

Our Approach

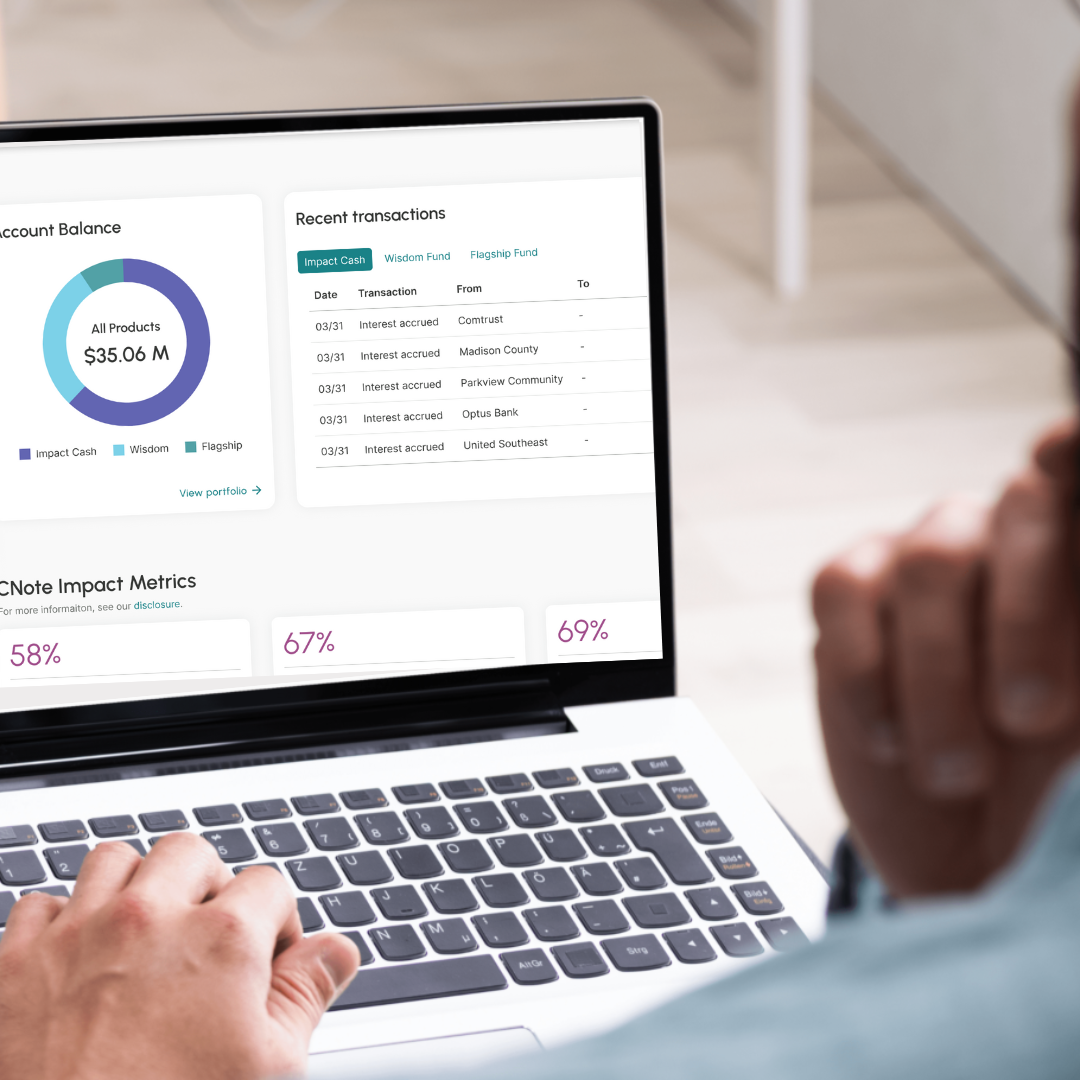

CNote’s platform is designed for competitive returns while driving meaningful impact. Traditionally, investors have faced a trade-off between financial performance and supporting their values—but with CNote’s impact investing solutions, you no longer have to choose between the two.

Our platform connects your dollars to a carefully vetted ecosystem of mission-driven financial institutions, delivering measurable financial returns alongside positive social and economic outcomes. With full transparency, 24/7 account access, and detailed performance insights, you can stay informed and confident that your dollars are supporting the causes that matter most to you.

CNote makes impact investing easy, measurable, and scalable.

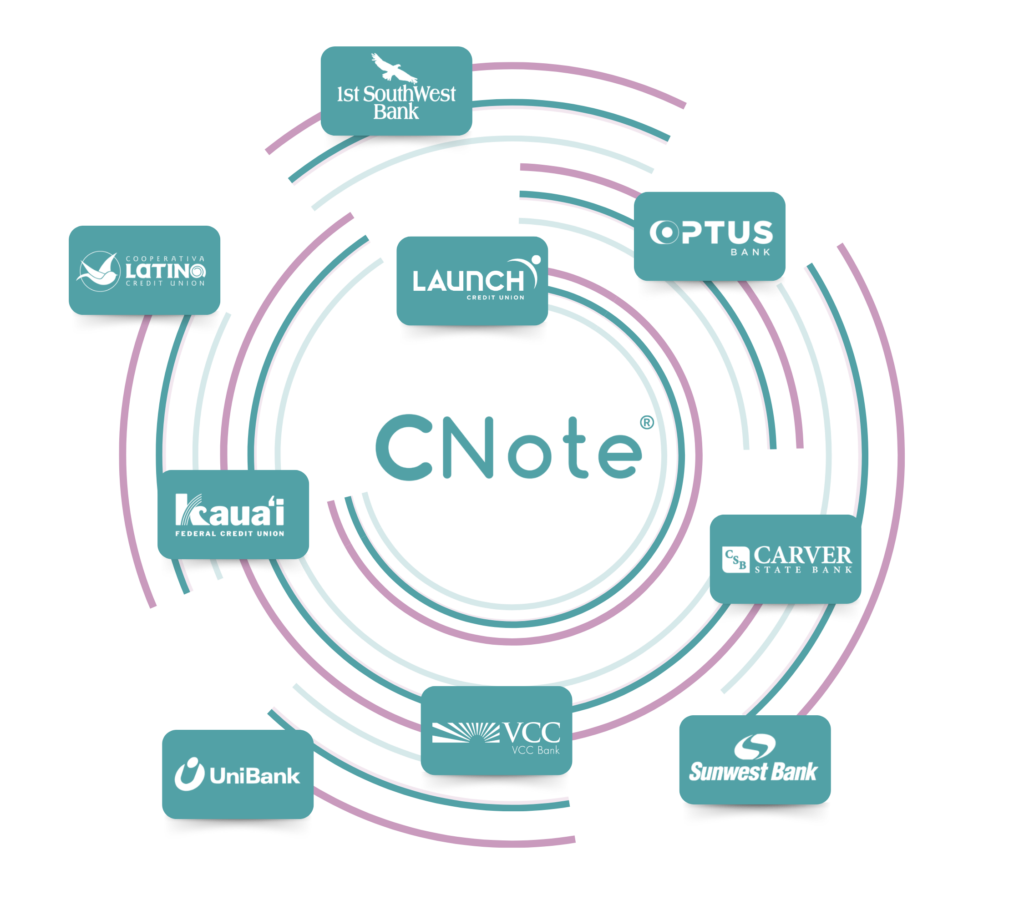

Our Partners

CNote has a network of over 2,500+ mission-driven financial institutions, including federally certified Community Development Financial Institutions (CDFIs), Minority Depository Institutions (MDIs), and Low-Income Designated (LID) credit unions. These community-focused partners are carefully vetted to meet rigorous federal program guidelines and demonstrate strong impact performance.

Through our intentional vetting approach, we ensure our partners consistently deliver financial resources and increased lending activity to underserved communities, aligning with our mission to drive measurable impact.

Customized Impact Investments

CNote offers tailored impact investing solutions designed to align with your unique goals and objectives. Whether you are looking to invest in your backyard, align with a specific impact theme or support where your customers, donors or employees live, our team works closely with you to create a customized offering that meets your financial and impact priorities.

Place-Based Investing

CNote enables investors and corporations to make a targeted impact with place-based investing. Our extensive network of partners spans all 50 states, providing the flexibility to focus on specific regions or even specific cities. Whether your goal is to support local economic growth or address unique needs in a particular area, CNote makes it simple to invest where your employees live and where your customers buy.

Targeted Impact Themes

CNote provides 26 thematic investing options, allowing you to align your investments with causes that matter most—such as Climate Change, Affordable Housing, Racial Equity, and Refugee and Immigration Issues. Prefer a larger framework? CNote also maps investments to the UN Sustainable Development Goals (SDGs), making it easy to connect your financial goals with meaningful, measurable impact.

- Only invested principal is insured. The interest rate may vary over the life of your investment. Accrued interest payments are not subject to insurance coverage. You should carefully review all offering documents prior to investing. ↩︎

- Only invested principal is insured. The interest rate may vary over the life of your investment. Accrued interest payments are not subject to insurance coverage. You should carefully review all offering documents prior to investing. ↩︎

- For more information on risks related to investing in our Flagship Fund Notes, for unaccredited investors please see our latest Flagship Fund Offering Circular as filed with and qualified by the SEC, and for accredited investors please see our latest Flagship Fund Private Placement Memorandum ↩︎

- Returns are not guaranteed. The Flagship Fund issues Adjustable Rate Promissory Notes that are non-recourse obligations of CNote and involve the risk of loss, including principal. You should carefully review the all offering documents including note terms prior to investing. ↩︎

- CNote has management discretion around liquidity and currently offers clients quarterly liquidity up to $20,000 or 10% of invested assets, whichever is greater. At a minimum, CNote investors will have access to 10% of their investment every quarter. For full investment terms see the Offering Circular for unaccredited investors and the Private Placement Memorandum for accredited investors.

↩︎ - For more information on risks related to investing in our Wisdom Fund Notes, for accredited investors please see our latest Wisdom Fund Private Placement Memorandum. ↩︎