America, “the land of equal opportunity”, isn’t delivering on its promise for the 90 percent that find themselves on the wrong side of the ever-widening wealth gap. In fact, the United States has a level of wealth inequality between the rich and poor that is larger than any other major developed country. According to the National Bureau of Economic Research, the richest 5 percent of Americans own two-thirds of the wealth in the nation.

While there are many reasons for this divide, one of the key contributors is unequal access to credit and other mainstream financial products and services. Unlike the top one percent who invest their wealth in stocks and mutual funds, homeownership is the main source of wealth for 90 percent of Americans. This is also the asset type that suffered the biggest setback during the Great Recession of 2008.

Financing for homeownership.

For those who find themselves locked out of being able to access credit, getting a mortgage to buy a home seems like an impossible feat. This most often hits low-income communities the hardest, as many have historically been discriminated against through unfair practices like redlining, which despite efforts to halt still exists in some form today.

The lack of access to credit also negatively affects Main Street America because, without business loans, many small business owners struggle to grow their companies. For minority- and women-owned businesses (MWBEs or WMBEs) this can be catastrophic because investment in MWBEs is 80 percent lower than the average investment in businesses overall.

Not only are working and middle-class American households severely impacted by unequal access to credit, but these negative effects trickle down into their communities and the country as a whole by stifling productivity and innovation while continuing to increase wealth inequality.

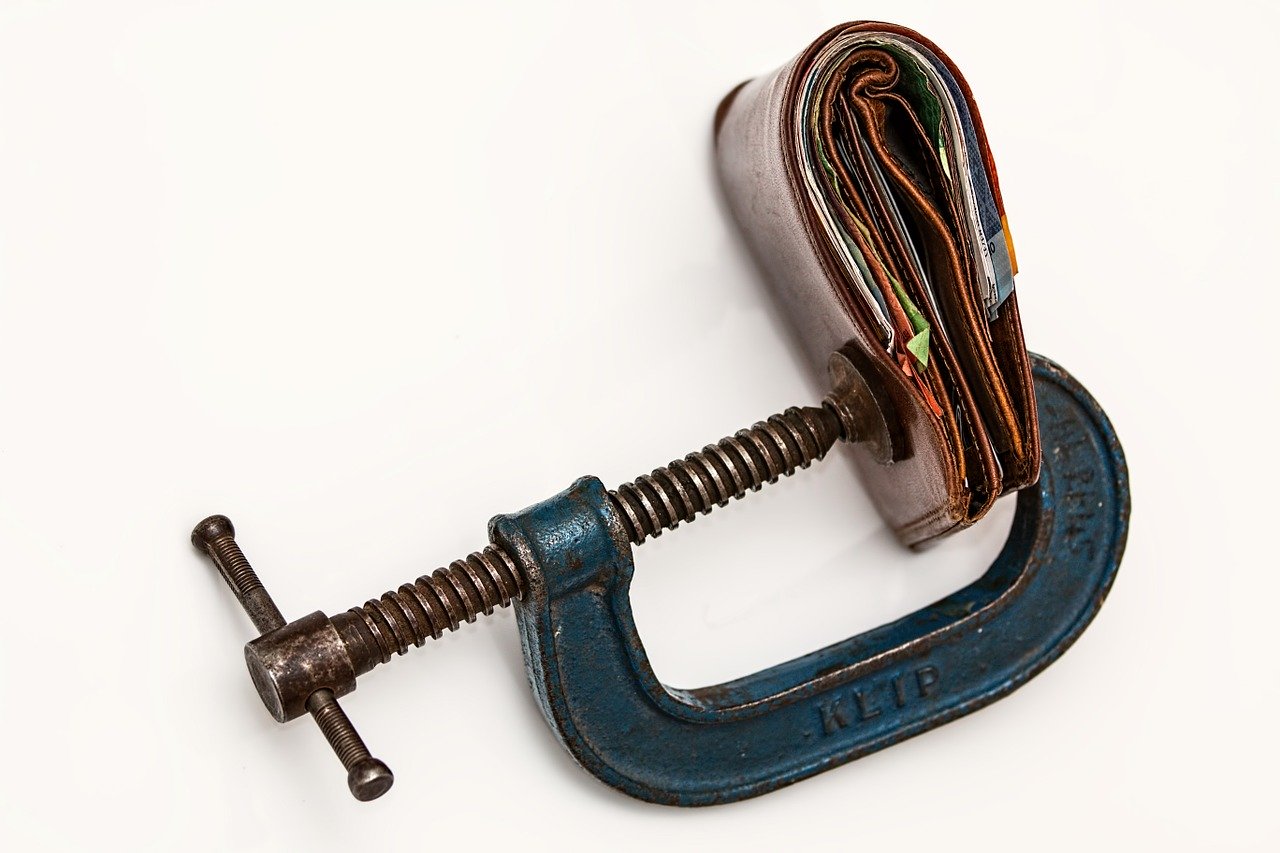

The challenge of accessing credit for lower-income households

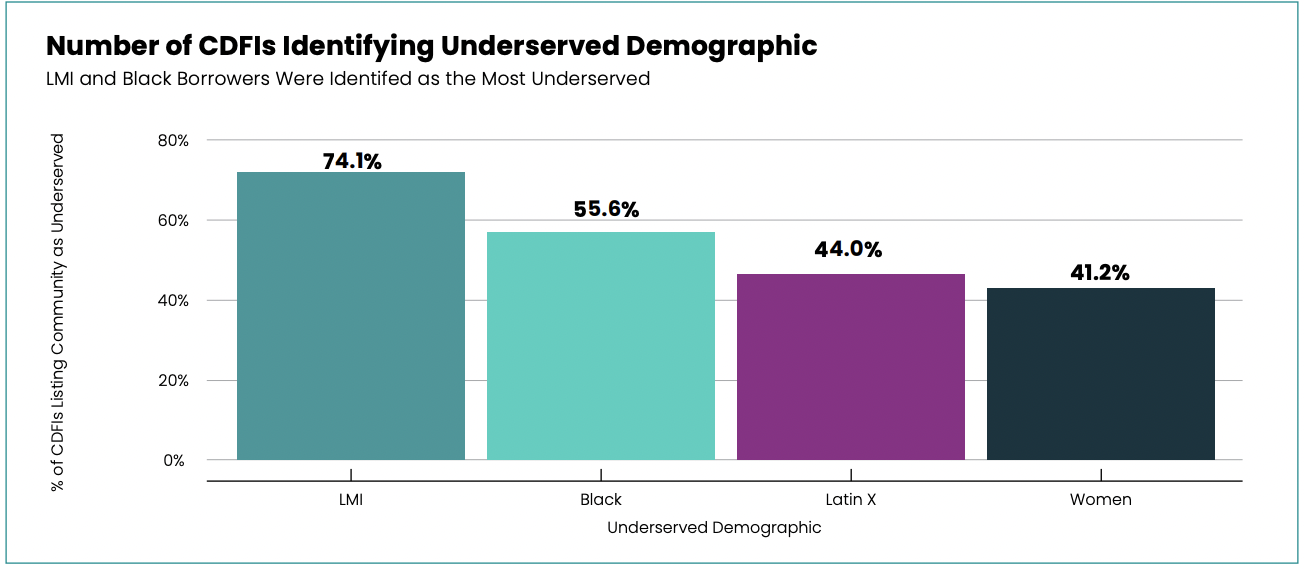

In a 2017 survey by the Federal Deposit Insurance Corporation, over 8 million households were found to be unbanked. And 80.2 percent of unbanked households had no access to mainstream credit. The survey also found that lower-income, less educated, black and Hispanic, working-age, disabled, and foreign-born, noncitizen households were more likely to not have access to mainstream credit. Differences in credit access by income, education, race, and ethnicity were the most striking, with the youngest households (aged 15 to 24 years) following close behind.

Without access to traditional banking products like savings accounts, many of these households are one paycheck away from financial ruin. Seemingly minor financial rules about fees, fines, interest rates, and minimum balances made in the boardrooms of banks and other companies make life much more difficult for low-income families. These practices often force families to rely on alternative financial services such as payday lenders, check cashing services, pawnshop loans, and auto title loans that charge extremely high-interest rates. This exacerbates the wealth gap by keeping borrowers stuck in a cycle of crushing debt.

While some may argue that the deregulation of these alternative financial industries is the solution, in reality reducing barriers to economic inclusion is the only way forward for households unable to access mainstream credit products and services. According to a recent article by the Brookings Institute, “Economies that extend opportunity widely not only maximize their productive potential but also minimize the fiscal and social costs of exclusion. These costs are significant.”

The author, Joseph Parilla states that “Childhood poverty—one outcome of insufficiently inclusive growth—costs the U.S. economy an estimated $500 billion a year, or four percent of GDP, due to lost productivity, higher crime and incarceration, and larger health expenditures. Cities end up bearing these costs, at the expense of other important investments in growth and opportunity. The final cost of unequal opportunity gets beyond the numbers. Inequality of opportunity provokes hostilities that fray social and political cohesion and good governance, which affects economic growth.”

Why lack of credit access curbs small business and community development

Small businesses rely on access to credit as much as American households. In fact, access to credit is so essential to businesses that a government agency called the U.S. Small Business Association is dedicated to “connecting entrepreneurs with lenders and funding to help them plan, start and grow their business.”

Coastal Enterprises, Inc. (CEI), an SBA 7(a) lender has financed 2,555 businesses for over $1 billion in Maine and other rural areas across the nation. Betsy Biemann, CEO says, “These are businesses that often would have trouble accessing traditional capital from traditional lenders.”

Coastal Enterprises, Inc. (CEI), an SBA 7(a) lender has financed 2,555 businesses for over $1 billion in Maine and other rural areas across the nation. Betsy Biemann, CEO says, “These are businesses that often would have trouble accessing traditional capital from traditional lenders.”

Many small businesses depend on credit access for startup costs, capital improvements, and to meet everyday expenses like payroll. While it’s easier for larger companies to attract lenders, for small businesses, lack of credit can cause them to close their doors forever.

Howard Schultz, Starbucks CEO who is credited with transforming the coffee giant from a regional company into a top global brand has stated that “the lifeblood of job creation in America is small business, but they can’t get access to credit.”

With a less stable job market, many more millennials are also becoming entrepreneurs than previous generations. According to a recent study by America’s SBDC, 62 percent of millennials have a dream business they would love to start while nearly half reported that access to capital is the biggest barrier to starting a business.

How unequal access to credit threatens the US economy

Despite the expansion of the United States’ economic power throughout the past century, the growth in household wealth outside of high earners has not been inclusive. In 2016, white households had more than ten times the wealth of black families according to economic research by McKinsey.

The racial wealth gap alone constrains the entire U.S. economy. McKinsey estimates that “its dampening effect on consumption and investment will cost the US economy between $1 trillion and $1.5 trillion between 2019 and 2028—4 to 6 percent of the projected GDP in 2028.”

Black families still must contend with systemic discrimination, poverty, and a lack of social connections in the effort to build wealth. The National Fair Housing Alliance (NFHA) is a trade association that works to eliminate housing discrimination and to address the lack of access to credit that severely limits the accumulation of wealth for people of color.

In tandem with practices like redlining, housing policies were established from the inception of this nation that “were expressly designed to assist whites in gaining land and homeownership rights while simultaneously denying people of color the same opportunities” states the NFHA.

The shocking millennial wealth gap

Millennials have the undesirable distinction of being the first generation to accumulate less wealth than previous generations. The Federal Reserve report, “Are Millennials Different?,” disclosed that Millennials have “lower earnings, fewer assets and less wealth” than previous generations at the same age. The Federal Reserve’s Survey of Consumer Finances also reported that despite making up about a quarter of the population, millennials own only 3% of the country’s wealth.

This is due in part to coming of age in the job market during the financial crisis of the Great Recession. During this time, the labor market was at historically weak levels and credit conditions were unusually tight. Also, increased higher education and health costs contributed to millennials carrying greater levels of debt and having far less money to spend. And even when working full-time hours, millennials can’t afford to buy homes according to a 2017 National Housing Survey by Fannie Mae.

The impact of restricted credit access and lack of economic inclusion among racial and generational lines is having a ripple down effect on the U.S. economy that is maintaining a persistent and widening wealth gap for the majority of Americans. And when the gender pay gap, education level, immigration status, disability, and other factors are added to this as well, addressing wealth inequality and credit access is even more critical.

The impact of restricted credit access and lack of economic inclusion among racial and generational lines is having a ripple down effect on the U.S. economy that is maintaining a persistent and widening wealth gap for the majority of Americans. And when the gender pay gap, education level, immigration status, disability, and other factors are added to this as well, addressing wealth inequality and credit access is even more critical.

What’s the way forward to improving access to credit?

The Consumer Financial Protection Bureau (CFPB) estimates that “26 million Americans can be classified as credit invisible and 19 million have a credit history that is insufficient to produce a credit score.” CFPB is urging lenders to deploy innovative ways of increasing access to credit. Upstart Network is a nonbank lender that deployed a machine learning model to improve access to credit that abides by fair lending practices.

Community Reinvestment Act (CRA) reforms that include the expansion of CRA credit to banks that work with Community Development Financial Institutions (CDFIs) have also been proposed. This would modernize the current rules to require banks to lend and invest in all regions where they receive significant deposits, also taking into account internet banks that have only one physical branch. Although, some community groups and low-income advocacy associations have voiced concerns about these changes placing an emphasis on the dollar amount of CRA projects that would lead to receiving less capital from bank partners.

Using alternative credit data to support those who are underbanked and have limited access to credit is another possible solution. Alternative credit scoring models take into account a broader range of criteria than current models that require an individual to have at least one active credit account that displays activity for over six months. The latest FICO 9 score model excludes paid and unpaid medical debt from credit scores and a new credit scoring model from VantageScore ignores accounts referred to collection agencies that have been paid off.

Fintech startups are also innovating financial services and banking as millennials adopt new investment vehicles like cryptocurrency, point-of-sale lending alternatives, digital-first banks like Simple and Chime, AI-based budgeting and expense monitoring, robo advisors, micro-investing apps like Acorn and Stash, and virtual credit cards. Impact investing is also increasingly popular among millennials who have a strong interest in investing in small business.

Smartphone apps allow people to invest and manage accounts from their fingertips.

SBA and first-time home buyer loans along with other government programs can assist in paving the way for opening up opportunities to grow wealth for more Americans. Ultimately, many essential reforms are needed within the financial, housing, employment, healthcare and many other sectors of America’s infrastructure to achieve lasting change.

Six essential policy solutions have been pinpointed by the HAAS Institute for a Fair and Inclusive Society for reversing inequality, closing the wealth gap and expanding economic inclusion. Access to fair, low-cost financial services and increasing homeownership is listed as crucial for building American households’ wealth.

Conclusion

An important part of financial health is building assets to generate wealth. Historically, the working and middle class in the U.S. have grown wealth through homeownership and creating small businesses. The wealth gap grows when only some populations in the U.S. are able to access credit and the mainstream financial products that are oftentimes necessary to do so.

The Federal Reserve Bank of New York developed The Credit Insecurity Index to collect various Community Credit indicators to understand the impact of credit constraints on U.S. communities. Through their research, they found that communities with more access to credit are better off than communities with less access, as they are able to strive for upward economic mobility and weather unexpected financial hardships such as the subprime mortgage crisis that happened during the Great Recession.

Woman holding a protest sign for change.

Without far-reaching, structural reforms to our society, the deep and persistent wealth gap in America cannot be bridged. Public policies such as redlining and housing and wage discrimination have suppressed the wealth of many generations of women and people of color. To ensure subsequent generations have a better chance of building wealth, expanding economic inclusion is imperative. This, in turn, supports the closing of the wealth gap, and the growth and stability of all communities, the country, and even our planet.

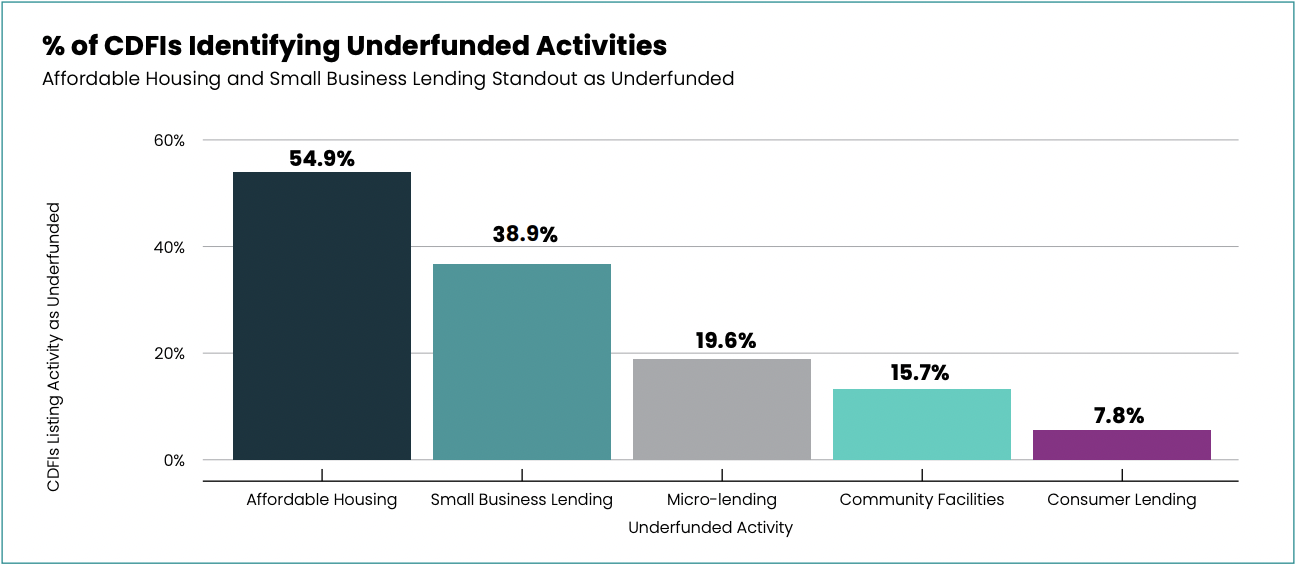

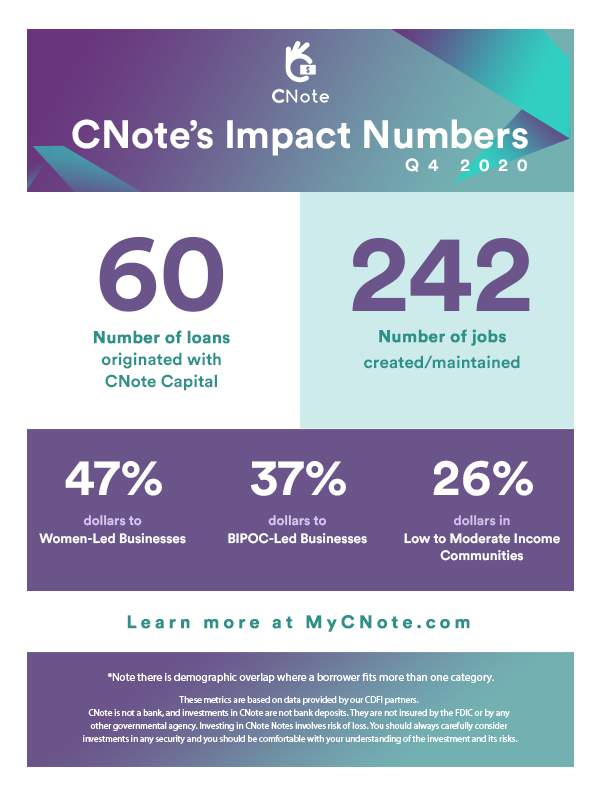

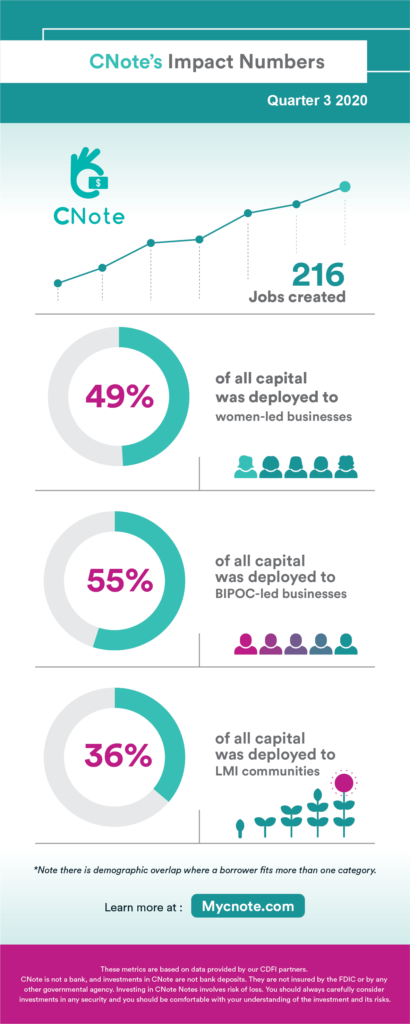

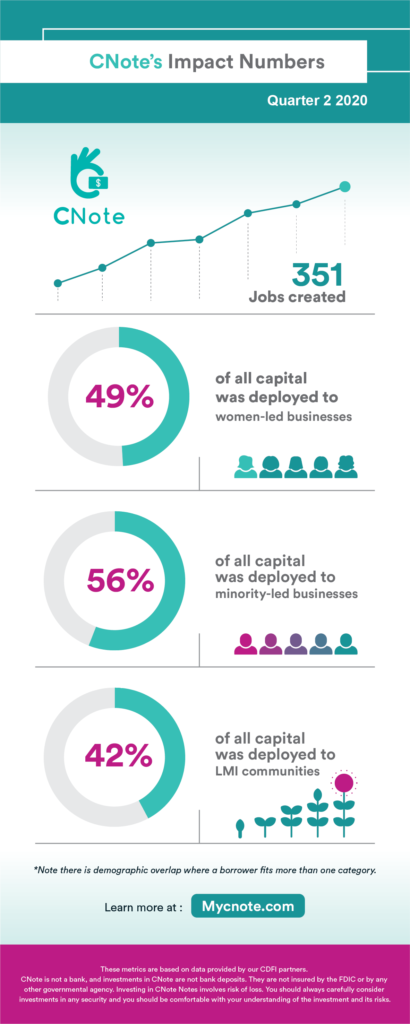

Looking to support increased access to financial resources in underserved communities? CNote recently launched The Promise Account for foundations and other institutional investors that provides capital to financially vulnerable communities and is optimized for returns, insurance, and impact. Every dollar invested in our platform goes towards funding MWBEs, affordable housing, and economic development.

55% affordable housing lending

55% affordable housing lending

This piece was authored by Danielle M. Burns, MBA, AIF®, VP of Business Development at CNote. She is also an internal champion of the Wisdom Fund and is leading the human-centered design work on this project.

This piece was authored by Danielle M. Burns, MBA, AIF®, VP of Business Development at CNote. She is also an internal champion of the Wisdom Fund and is leading the human-centered design work on this project.

About CNote

About CNote

In a 2009 industry assessment, the

In a 2009 industry assessment, the

In their role as “financial first responders” CDFIs are perfectly suited to provide a rapid response to the pandemic. CDFIs have a long track record of absorbing economic turmoil and thriving during downturns while investing in underserved communities to help them weather unforeseen financial emergencies.

In their role as “financial first responders” CDFIs are perfectly suited to provide a rapid response to the pandemic. CDFIs have a long track record of absorbing economic turmoil and thriving during downturns while investing in underserved communities to help them weather unforeseen financial emergencies.

Some CDFIs even tailor their loan programs and financial products specifically to

Some CDFIs even tailor their loan programs and financial products specifically to

For example, institutional investors like community foundations can target thematic and place-based investment goals through CNote, a platform that simplifies the deployment of capital across a pool of CDFIs.

For example, institutional investors like community foundations can target thematic and place-based investment goals through CNote, a platform that simplifies the deployment of capital across a pool of CDFIs.

Given the prevalence of addiction in the community, coupled with the overall lack of resources to combat it, it wasn’t surprising that people came together in February 2016 to express their outrage and to publicly acknowledge that addiction was a serious problem. What was frustrating, however, was the lack of collective action that ensued.

Given the prevalence of addiction in the community, coupled with the overall lack of resources to combat it, it wasn’t surprising that people came together in February 2016 to express their outrage and to publicly acknowledge that addiction was a serious problem. What was frustrating, however, was the lack of collective action that ensued.

Learn More

Learn More

Coastal Enterprises, Inc. (CEI), an

Coastal Enterprises, Inc. (CEI), an  The impact of restricted credit access and lack of economic inclusion among racial and generational lines is having a ripple down effect on the U.S. economy that is maintaining a persistent and widening wealth gap for the majority of Americans. And when the

The impact of restricted credit access and lack of economic inclusion among racial and generational lines is having a ripple down effect on the U.S. economy that is maintaining a persistent and widening wealth gap for the majority of Americans. And when the

Phil said that over time, he’s warmed to the co-op model, and he’s happy with the outcome. He said that without Jeanee, it would have been “next to impossible” to have navigated the mechanics of it all. Margaret echoed his sentiments. “We’re grateful to The Genesis Fund for stepping in to help us make this possible.”

Phil said that over time, he’s warmed to the co-op model, and he’s happy with the outcome. He said that without Jeanee, it would have been “next to impossible” to have navigated the mechanics of it all. Margaret echoed his sentiments. “We’re grateful to The Genesis Fund for stepping in to help us make this possible.” Learn More

Learn More

Dan Schulman, President and CEO at PayPal, shared these comments on this initiative “A critical component to closing the racial wealth gap is economically empowering underrepresented communities that have traditionally been shut out of opportunities to build and sustain wealth. Whether it’s helping someone purchase a home or open their own business, these institutions are on the front lines of creating financial stability and expanding opportunity for traditionally underserved communities. We are proud to partner with them as we work together to advance economic equity and racial justice.”