Optimize Corporate Cash Reserves While Supporting Local Communities

Maximize the impact of your corporate cash strategy with solutions that align financial performance and social responsibility. CNote’s cash management solutions are designed to meet the priorities of corporate treasurers—delivering liquidity and competitive returns, integrated with treasury management software, and the security of 100% FDIC and NCUA insurance coverage.

With CNote, your cash reserves do more than grow—they actively support underserved communities, small businesses, and local economies, while helping your company meet its financial goals and sustainability objectives. Take the next step in making your cash strategy a tool for both financial growth and measurable impact

Impact You Can Trust

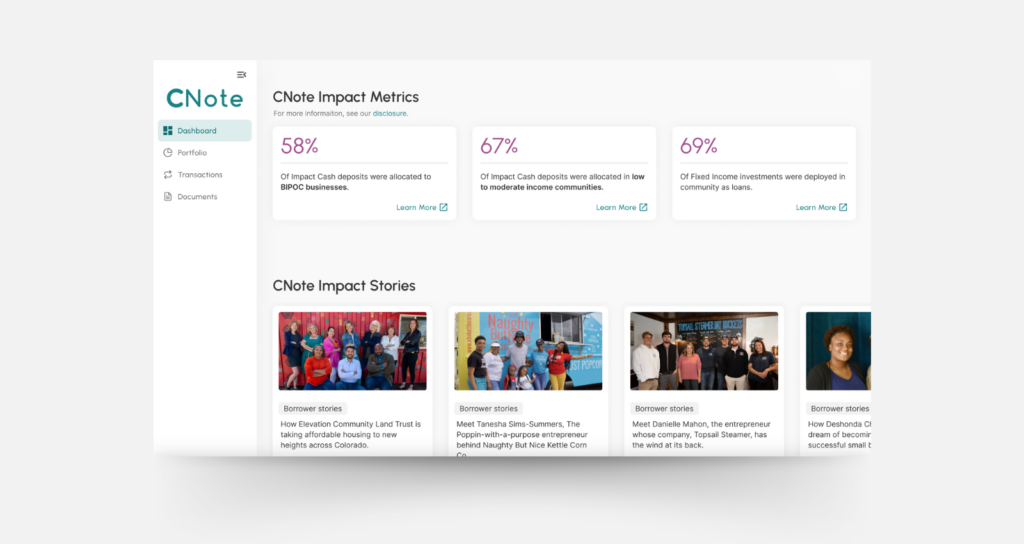

Gain unparalleled transparency and alignment with your business goals. CNote’s quarterly impact reports go beyond the numbers, offering detailed insights, meaningful metrics, and transformative stories that highlight the positive change your deposits are supporting.

With CNote, impact reporting is tailored to your objectives. Whether you’re prioritizing racial justice, disaster recovery, affordable housing, or small business growth, our reports show how your deposits make a measurable difference where it matters most—where your employees live and your customers buy.

Build Stronger Cash Reserves

Maximize the potential of your corporate cash reserves with CNote’s secure and competitive cash management solutions. By leveraging 100% FDIC- and NCUA-insured deposits, you can achieve steady financial growth while ensuring your capital is protected. Turn your idle cash into a powerful asset that drives measurable returns without compromising on security.

Enjoy Competitive Returns

CNote’s cash management solutions for corporations offer returns that rival—and at times exceed—those of traditional banks. By placing deposits with mission-driven financial institutions1, you can earn strong financial results while supporting meaningful economic growth in local communities.

With CNote, your cash doesn’t just sit idle—it works strategically to deliver both competitive returns and measurable impact, aligning with your financial strategy with your social values and goals.

Liquidity When You

Need It

Your cash reserves should be as dynamic as your business. CNote provides access to flexible liquidity, ensuring you’re equipped to handle both anticipated expenses and unforeseen financial demands with confidence. Our tailored cash management solutions for corporations offer the control and convenience you need to manage corporate cash efficiently, keeping your funds readily accessible at all times.

How It Works

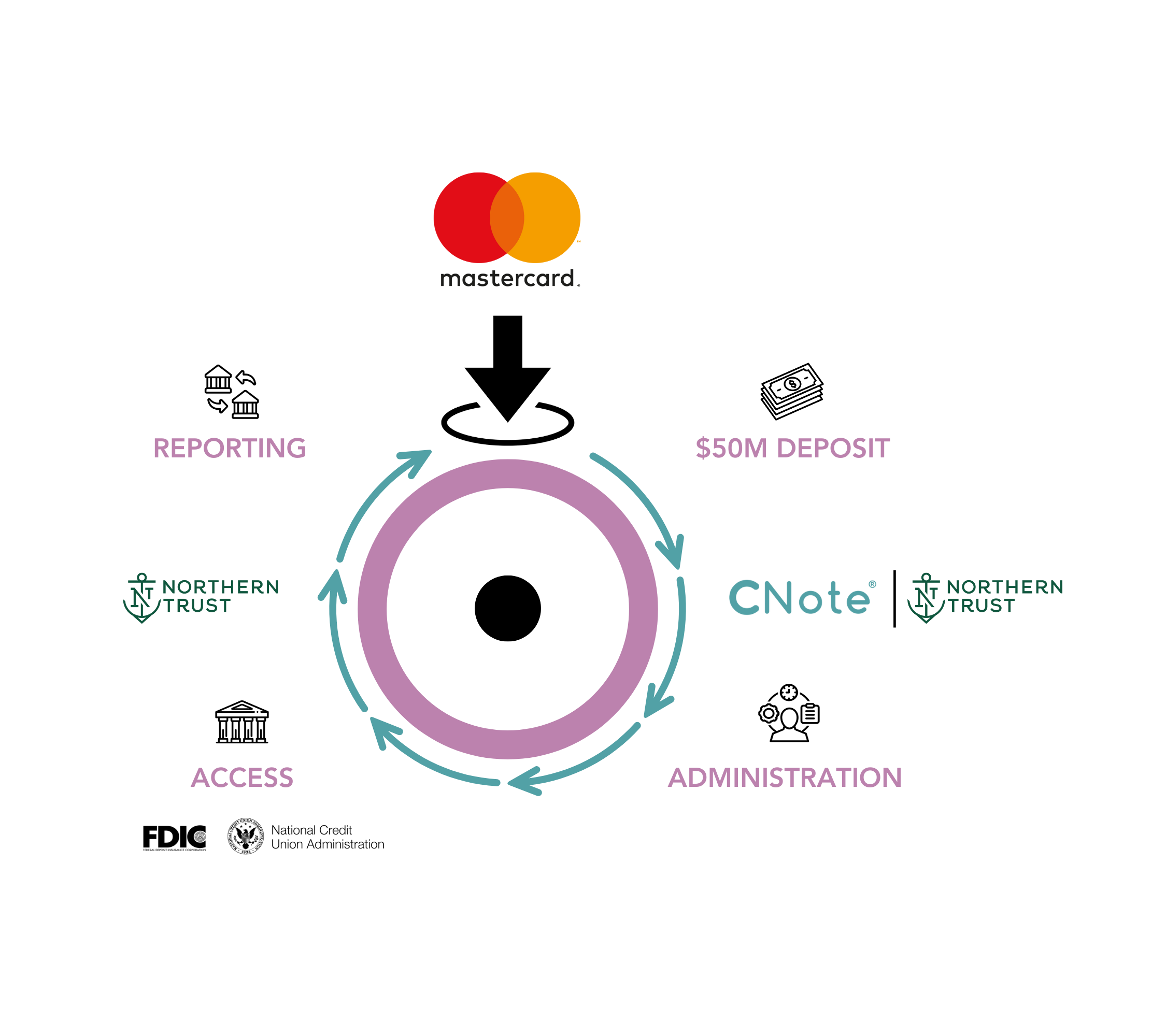

CNote simplifies how you can work with mission-driven financial institutions. Traditionally, deploying cash required navigating over 400 steps, including identifying risk, analyzing data, negotiating rates, and maintaining transaction histories.

CNote streamlines this process into just three simple steps:

1. Financial Parameters and Impact Targets – Share your financial parameters and impact targets to align your goals and strategy.

Example: returns, duration, impact

2. Account Administration – CNote will match your parameters with our robust network, and will open FDIC-insured accounts for your exclusive benefit. Deposits are wired or transferred (ACH) to your FDIC-insured accounts at mission-driven financial institutions

Note: CNote handles administrative hurdles but does not touch any money or money flows.

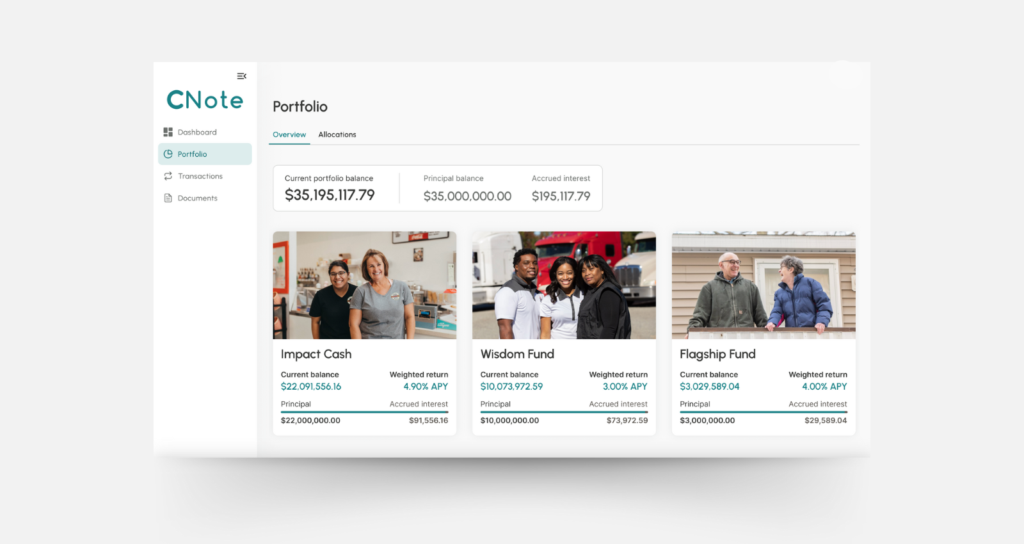

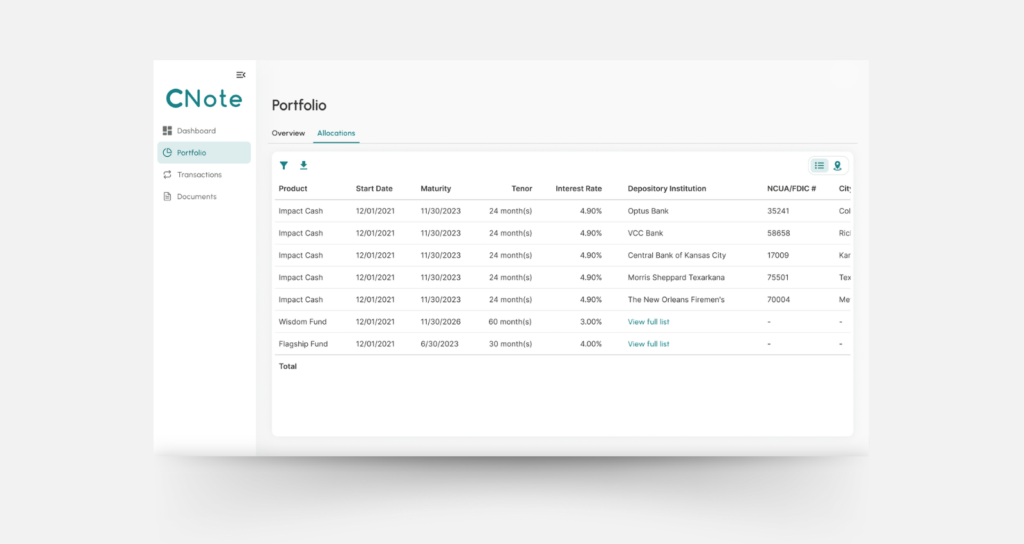

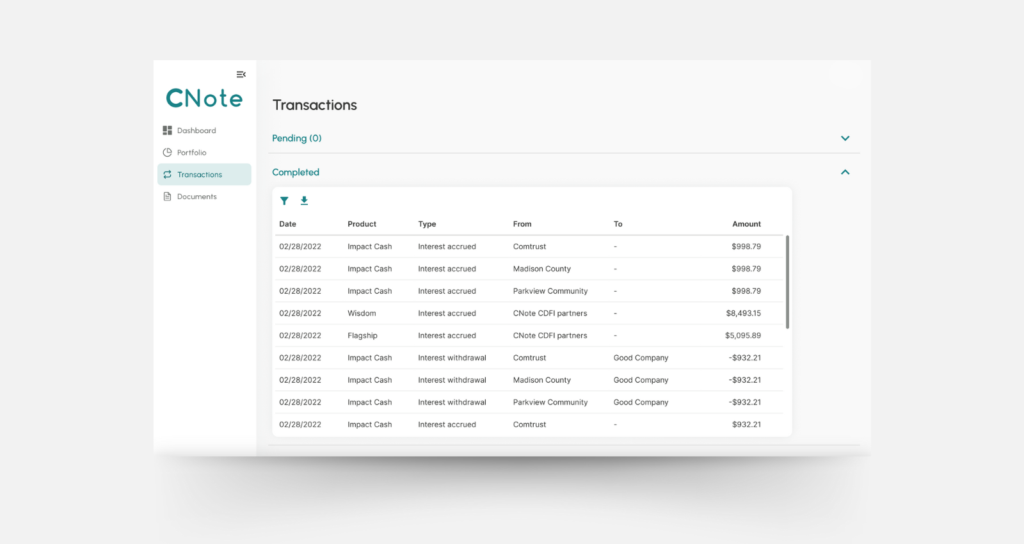

3. Receive reports and statements – All financial statements and reporting are communicated through your CNote dashboard and/or your treasury management or accounting software system (example: Clearwater, GT, etc.)

By leveraging CNote’s innovative platform, you gain access to a network of over 2,500 mission-driven financial institutions, including Self-Help Credit Union, Virginia Community Capital, Carver Bank, and more, without the hassle of managing each step yourself.

Ready to Make an Impact?

Put your corporate cash reserves to work with CNote. Earn competitive returns, meet your financial goals, and drive meaningful change in communities nationwide—all while maintaining complete transparency through our quarterly impact reports. CNote’s cash management solution for corporations is designed to set your company and impact goals ahead.

Impact Cash®

Earn competitive blended return with CNote’s Impact Cash® while ensuring your money is safe, fully insured, and driving positive change. Your funds are placed in mission-driven financial institutions that support small business growth, affordable housing, disaster relief, and local economic development in underserved communities across the country.

![]() Competitive Blended Returns

Competitive Blended Returns![]() Cash with Impact

Cash with Impact![]() 100% FDIC and NCUA Insurance Coverage2

100% FDIC and NCUA Insurance Coverage2![]() Flexible Liquidity

Flexible Liquidity![]() Supports CDFI Banks and Credit Unions

Supports CDFI Banks and Credit Unions

Climate CashTM

Earn competitive blended return on your deposits with CNote’s Climate Cash™ while helping to combat climate change and support environmental resilience. Your fully insured deposits are placed in mission-driven financial institutions funding renewable energy projects, sustainable agriculture, green infrastructure, and other initiatives that build a more sustainable future.

![]() Competitive Blended Returns

Competitive Blended Returns![]() Combat Climate Change with your Deposits

Combat Climate Change with your Deposits![]() 100% FDIC and NCUA Insurance Coverage3

100% FDIC and NCUA Insurance Coverage3![]() Deposit up to $50M in Climate-Friendly Insured Deposits

Deposit up to $50M in Climate-Friendly Insured Deposits

Make a Difference with Deposits.

See where how corporate deposits make a difference through Impact Stories from both Impact Cash® and Climate CashTM

As the U.S. approaches another election cycle, corporate treasurers are prepared for a period marked by heightened uncertainty and cautious decision-making. Election periods often bring the potential for significant policy shifts, market volatility, and broader economic disruptions, making it crucial for treasurers to adopt a proactive approach to managing financial risks. A Time of Pause […]

Corporate treasurers play a vital role in managing a company’s cash holdings, ensuring that deposits are secure, accessible, and positioned to generate returns. In today’s economic landscape, the need for secure, impact-aligned deposit strategies is more pressing than ever. Treasurers often face the challenge of balancing capital preservation, liquidity, and return—while also fulfilling corporate mandates […]

In today’s rapidly changing financial landscape, the phrase “we mean now” has taken on new significance. The demand for next-day liquidity is no longer a niche requirement but has become the common currency for corporate treasurers and financial managers. This shift is driven by market uncertainty, economic volatility, and the need for businesses to maintain […]

Subscribe to CNote’s Corporate Newsletter

Subscribe to CNote’s corporate newsletter and gain industry insight and education on Impact Deposits and Investing.

- Only invested principal is insured. The interest rate may vary over the life of your investment. Accrued interest payments are not subject to insurance coverage. You should carefully review all offering documents prior to investing. ↩︎

- Only invested principal is insured. The interest rate may vary over the life of your investment. Accrued interest payments are not subject to insurance coverage. You should carefully review all offering documents prior to investing. ↩︎

- Only invested principal is insured. The interest rate may vary over the life of your investment. Accrued interest payments are not subject to insurance coverage. You should carefully review all offering documents prior to investing. ↩︎