While it may seem like a new trend, impact investing has roots that trace back centuries and it’s here to stay. But like any alternative investment strategy, public endorsement of the approach has varied. Throughout the years, hesitation stemmed from concerns about financial returns, the ability to measure social impact and stability of the markets.

Challenging skeptics’ concerns, socially responsible investments have ballooned to account for over 25%of assets under management in 2018. As today’s investors aim to align their portfolios with their morals, the resurgence of SRI revives the age-old question: Does impact investing have lower returns?

Does impact investing have lower returns?

In short, most studies report that socially responsible investments do not have lower returns than traditional investments. In fact, there is evidence of the opposite; most conclusions point to SRI having higher returns, especially when social impact is taken into account.

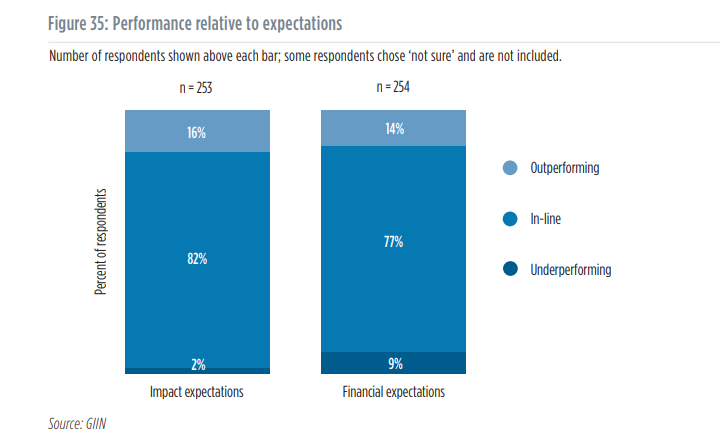

A comprehensive review by the Royal Bank of Canada looked into over 40 major studies and found that there was no evidence that socially responsible investing resulted in lower investment returns. This sentiment was echoed by the GIIN’s (Global Impact Investing Network) 2017 Annual Impact Investor Survey, which found that the majority of respondents achieved market-rate returns, with 91% claiming their returns met or exceeded their professional expectations. But in order to understand the full picture, we first need to explore both sides of the argument.

Concerns about impact investing

Much of the doubt surrounding returns on impact investments boils down to three major issues: the implementation of socially responsible principles, investor motivation and social impact.

Implementation

According to a study by Morgan Stanley, 75% said that their firm practices sustainable investing. However, 66% felt that there wasn’t enough data to prove that SRI offers a solid financial opportunity. While most investors agreed that a focus on sustainability provides clear competitive advantages to a business, they didn’t believe that socially responsible behavior reliably translated into financial gains. These investors believe there is obvious potential for increased financial returns through SRI, but a lack of framework or guidelines to realize them.

Another section of the report revealed that 70% of respondents agreed that there was no industry standard definition of sustainable investments. Driven by the rapidly-growing interest in SRI, some asset managers are using the ambiguity as a marketing opportunity. Rather than selecting investments based on principles and screenings, they offer products that barely qualify as socially responsible, hoping to attract capital from bright-eyed investors. This leads to the inefficient implementation of SRI principles, which reduces the potential for financial returns.

Investor expectations

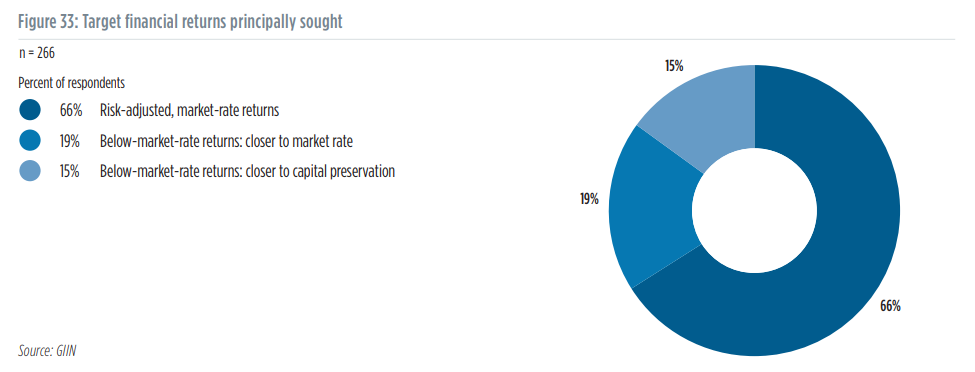

Looking past the implementation of socially responsible principles and creation of sustainable investment products, investor expectations drive some of the concerns about impact investment performance. Some investors are not motivated by financial returns, instead choosing investments based on values or long-term goals. Critics often forget that some people intentionally invest for below-market-rate returns to align with their strategic objectives, a factor that could reduce the perceived performance of impact investments. Generally, impact investors pursue one of three scenarios:

- Risk-adjusted market rate returns. These investors want to maximize financial returns while pursuing investments that have a positive social impact.

- Below-market rate returns (closer to market rate). This group aims to achieve steady returns by investing in companies that prioritize social responsibility.

- Below market rate (closer to capital preservation). Financial returns are not as important to these investors, who are willing to sacrifice earnings to support their beliefs.

Measuring social impact

Many people choose impact investments because they want their money to be used for good causes. While it’s inspiring to witness the shift towards sustainable investing, critics are rightfully concerned about the difficulty of measuring the social effects of impact investments. According to Morgan Stanley’s study, 70% of respondents agreed that there were no metrics to measure non-financial performance. While this factor doesn’t directly affect the financial returns of impact investments, it makes comparing overall performance to traditional markets more difficult.

Exploring criticisms of impact investing

At the end of the day, the notion that there is a tradeoff between financial performance and sustainability is an outdated myth. While concerns about impact investing are valid, critics suggesting that it has lower returns neglect to mention how poor implementation and profit-seeking behavior can negatively affect financial outcomes. Socially responsible investments and principles should prioritize the underlying cause, not the potential for financial returns.

Morgan Stanley’s study highlighted that most investors understood that SRI provides competitive advantages but didn’t think it translated into financial gains. However, research from Harvard revealed that the relationship between ESG and corporate performance is shaped by willingness to address sustainability issues that are relevant to company operations; when comparing financial returns, it found a difference of nearly 9% between companies that focused on sustainability factors that were fundamental to their industry and those who didn’t. Understanding and implementing ESG and socially responsible principles are key to financial performance.

Asset managers who use ESG principles as a marketing tactic (greenwashing) often miss the point of socially responsible investing. Their use of exclusionary screens to create sustainable investments loosely qualifies as impact investing, as there is little economic rationale behind the decisions. For example, an exclusionary screen in the car manufacturing industry would exclude all companies, while a proper ESG integration approach would consider firms that are investing in increasing fuel efficiency, electric vehicles, and extending life cycles. This mindset can lead to inefficient investment decisions and jeopardize returns in the process.

The main point of the above examples is that advisors and investors can make a larger impact when they understand how to properly implement investment screens. A 2016 study by Statman and Glushov found that screening methodology can directly impact performance. This finding implies that SRI reduces performance when investors use negative screens to exclude companies, but improves performance when investors use positive screens to select companies with high ratings on ESG indicators.

How do impact investments perform financially?

There have been plenty of attempts to prove that socially responsible investments have lower returns, but most of them come up inconclusive. This study, for example, found that socially responsible investments slightly underperformed, but admitted that there was uncertainty that may have influenced the outcome. The vast majority of evidence we’ve come across suggests that impact investments perform as well – or better – than traditional investments.

According to the GIIN’s 2017 study, “Evidence on the Financial Performance of Impact Investments,” socially responsible funds generated aggregate net returns of 5.8%. Based on a study of 71 market-rate-seeking private equity impact funds, it found that the top 5% achieved annual rates of return of 22.1% and above and the bottom 5% achieved -15.4% or lower. The report states that this range is similar to that of conventional investing, insisting that fund managers are key to strong performance.

Performance of impact investments holds stable even in smaller or volatile markets. The GIIN report found that funds investing in emerging markets generated a pooled return of 6.7%, compared to 4.8% for funds with a developed market focus. Bouncing back to Morgan Stanley’s report, evidence suggests that sustainable funds may also offer lower market risk. Of over 10,000 funds analyzed, sustainable funds experienced a 20% smaller downside deviation than traditional funds, even in turbulent markets. Data from 2008, 2009, 2015 and 2018 reveals that the downside deviation of sustainable funds was significantly smaller than that of traditional funds.

Case studies

Now that we’ve established that impact investments do not have to equal lower returns than traditional investments, we wanted to analyze a few situations to get a better look at how the two compare. To do this, we’re going to consider three case studies:

- Index comparisons

- Mutual fund comparisons

- ESG and credit portfolio performance

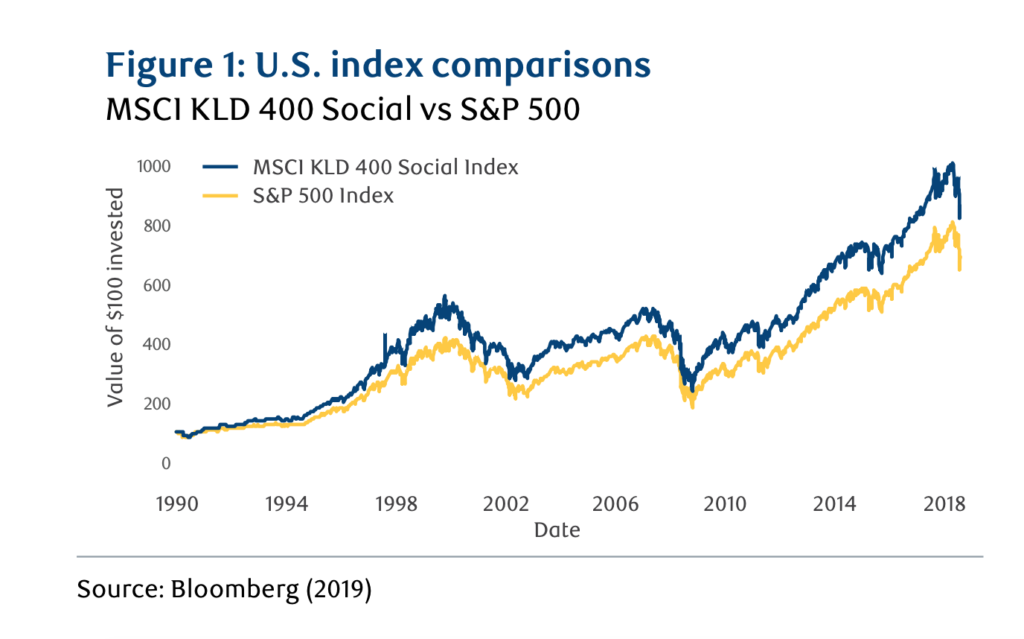

Case study #1: Index comparisons (MSCI KLD 400 vs. S&P 500)

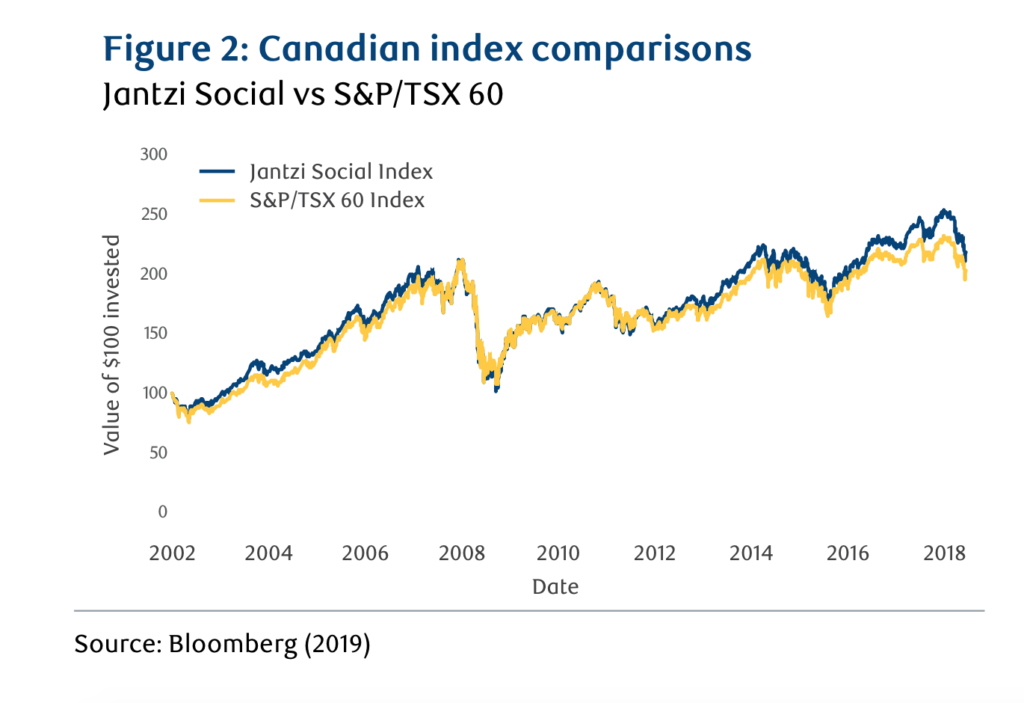

Going beyond individual funds, indices can provide a more general look at stock performance over time. The MSCI KLD 400 (formerly the Domini Social Index) (USA) and the Jantzi Social Index (Canada) are two major indices that track performance of socially responsible companies. We can analyze their performance by comparing them to traditional stocks as found on the S&P 500 and the TSX 60 indices.

The MSCI KLD 400, which was founded as the Domini Social Index, was established in 1990 and consists of 400 companies that meet rigorous standards for environmental excellence and social responsibility. Over the past 30 years, it has tracked performance of these companies against the S&P 500. As you can see, the social index has consistently outperformed traditional stocks for the past 25 years. With socially responsible investing gaining more momentum every year, the gap between the MSCI KLD 400 and the S&P 500 continues to grow.

The Jantzi Social Index was founded in 2000 in partnership with Dow Jones Indexes. Like the MSCI KLD 400, it’s a socially-screened, market capitalization-weighted common stock index. It consists of 50 Canadian companies that meet ESG criteria such as community involvement, corporate governance, the environment and human rights. While this index hasn’t been around as long as the MSCI KLD 400, it implies a similar outcome. Companies on this index have generally outperformed traditional stocks, especially after 2012.

In conclusion, the analysis of these two indices suggests that socially responsible investments outperform traditional investments, with a growing disparity in the late 2010s.

Case study #2: Mutual fund comparisons

From an investor perspective, mutual funds are one of the easiest ways to get involved in socially responsible investing. In order to determine whether SRI results in lower returns for retail investors, we are going to refer to a 2019 report by RBC.

The report analyzes 36 SRI fund studies from over 10 countries to compare SRI and non-SRI mutual fund performance. While evidence was mixed, a number of those studies support the conclusion that positive screens can be used to improve portfolio performance; after a certain number of screens have been applied, the companies remaining in the portfolio are lower risk and higher performance than non-sri counterparts. Another major finding was that the aggregate performance of SRI funds could be affected by the labeling (or lack thereof) of SRI funds, since the definition for SRI is so vague.

Overall, there is limited evidence to suggest that SRI funds systematically underperform traditional mutual funds. And while there is considerably more evidence that suggests that SRI mutual funds outperform traditional mutual funds, the results are not unanimous.

Case study #3: Barclay’s impact of ESG on credit portfolio performance

The final case study we want to explore measures the impact of ESG on credit portfolio performance, which is largely dominated by institutional investors. Based on a study done by Barclay’s in 2016, we aim to answer the following question: Does the incorporation of environmental, social and governance criteria in the investment process improve the financial performance of a bond portfolio or hurt it? A finding of that study was that, “a positive ESG tilt resulted in a small but steady performance advantage.”

Like many other forms of socially responsible investing, it can be difficult to measure the relationship due to the many aspects of ESG criteria. Results vary depending on geography, industry and market, but a survey in the Journal of Sustainable Finance & Investment draws a firm conclusion: Aggregating results from over 2,200 primary studies, the report states that roughly half of the published studies show a positive link between corporate social responsibility and corporate financial performance, while less than 10% report a negative link.

Based on the report from Barclay’s and the summary from the Journal of Sustainable Finance & Investment, we are confident that ESG can improve the performance of a bond portfolio.

Bottom line

In conclusion, there is overwhelming evidence to support the idea that socially responsible investments do not have lower returns than traditional investments, and very little evidence to support the opposing view. However, the guidelines for what makes a company or investment socially responsible are vague, making it tough to draw a fair comparison between SRI and non-SRI investments. However, many studies make it clear that it is possible to invest sustainably without sacrificing financial returns.