Optimize Foundation Cash While Supporting Communities and Causes You Care About

Amplify your foundation’s mission with an impact-driven cash strategy. CNote’s cash management solutions offer competitive returns, full FDIC and NCUA insurance, and on-demand liquidity, enabling your foundation to manage donor funds with confidence, integrity, and purpose.

With CNote, your capital becomes a catalyst for change—bringing dollars back into communities supporting local small businesses, affordable housing, and other positive impact areas.

How Foundations Can Work with CNote

Reserves

Allocation

Foundations can allocate a portion of their reserves to insured deposits at mission-aligned community financial institutions, allowing them to earn competitive returns, match liquidity needs, and align their funds with their impact-driven initiatives. By leveraging CNote’s Impact Cash® platform, foundations make their capital work harder, supporting communities in need without compromising financial goals.

Donor Impact Options

Transform donor generosity into lasting community change through CNote’s innovative funding model. Contributions can have double the impact when they sit in community financial institutions prior to any grant-making. Those contributions become revolving capital that continuously supports entrepreneurs, homebuyers, and community developers in underbanked areas, multiplying your impact far beyond traditional charitable giving.

Bank Locally

With Ease

CNote makes it easy for foundations to move deposits back into the local community without taking on additional administrative burden. With flexible liquidity and competitive rate options, you can earn more and support local impact with ease and transparency.

Make Your Cash Work Harder, Worry-Free

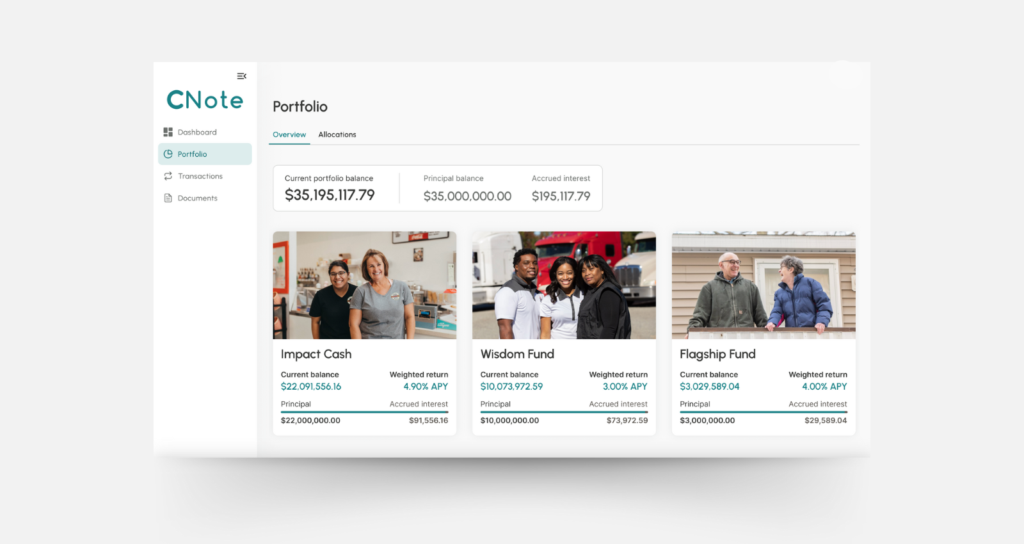

With 100% FDIC and NCUA insured cash deposits, CNote directs your funds with fully vetted Community Banks and Credit Unions, ensuring your capital supports local communities. Foundations can have up to $100M in insured deposits with the CNote Impact Cash platform.

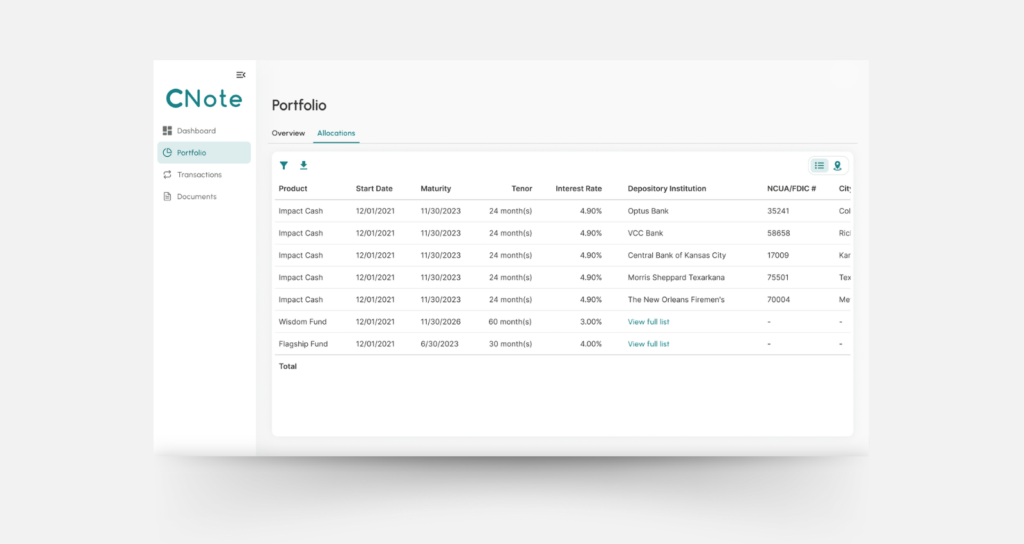

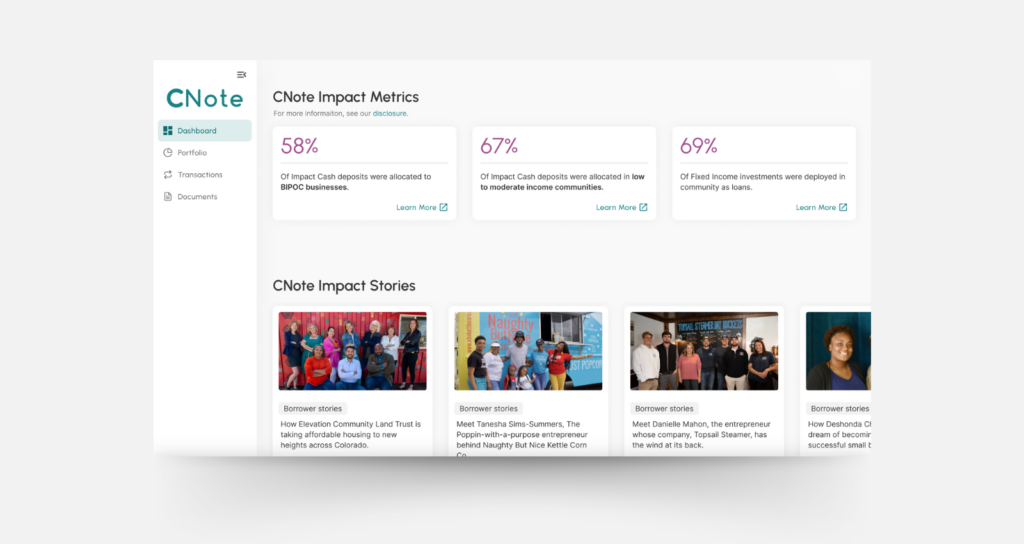

CNote provides in-depth, transparent impact reporting that goes beyond the numbers. You’ll receive insights into exactly where every dollar is deposited, including the communities it’s benefiting, and the measurable impact your funds are driving. This empowers you and your donors to track and celebrate the real-world impact you’re creating, ensuring that your capital is working as hard as you do for your mission.

Effortless Impact with CNote

With CNote, you don’t need a large team to make a big difference. Our platform handles all the heavy lifting from due diligence and matching to yield optimization and geo-targeting, so all you need to do is set your parameters, and we take care of the rest.

Whether you’re looking to grow reserves, offer impactful donor options, or ensure that every dollar works harder for your mission, CNote simplifies the process. Our intuitive platform streamlines the experience, allowing your foundation to focus on what matters most: driving impact without any added complexity or stress.

Explore How Your Foundation Can Earn More

Foundations don’t need to settle for low interest rates. With CNote, you can amplify your mission with competitive yields and flexible liquidity, offering donors impactful options by directly placing incoming funds into Community Banks and Credit Unions with our Impact Cash solution.

Impact That Matters

When foundations place deposits through the Impact Cash platform, they’re not just earning competitive returns, they’re directing capital to communities that need it most.

A $2 million deposit through CNote’s Impact Cash program can support:

- 40,000+ responsive and affordable loans originated, including over 15,000 in rural communities

- $245 million in small business lending

- $300 million in loans directed to low- to moderate-income communities

- 1,200+ affordable housing units created or preserved

Through intentional placement and transparent reporting, foundations can see how every dollar contributes to long-term economic resilience.

How It Works

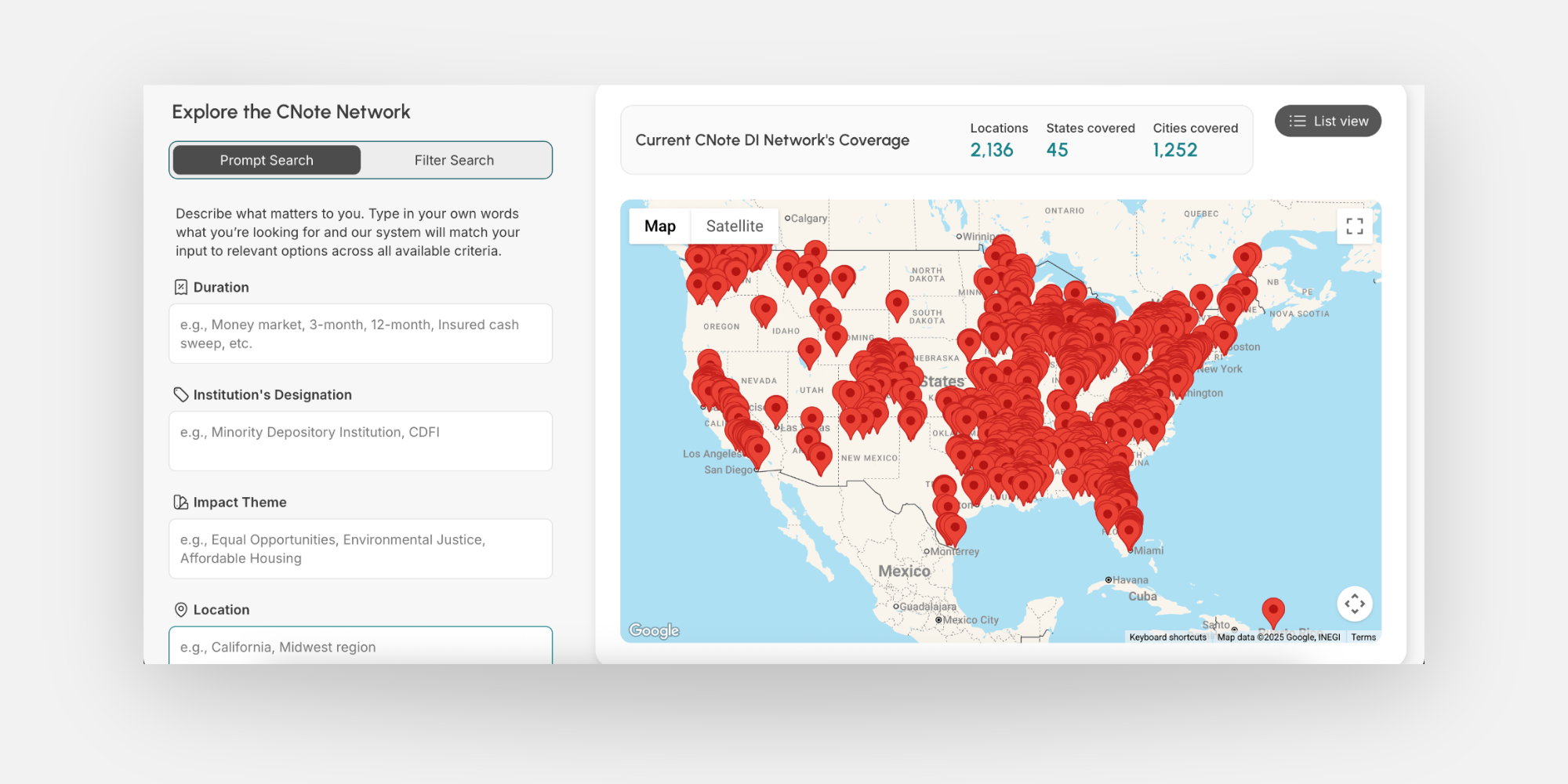

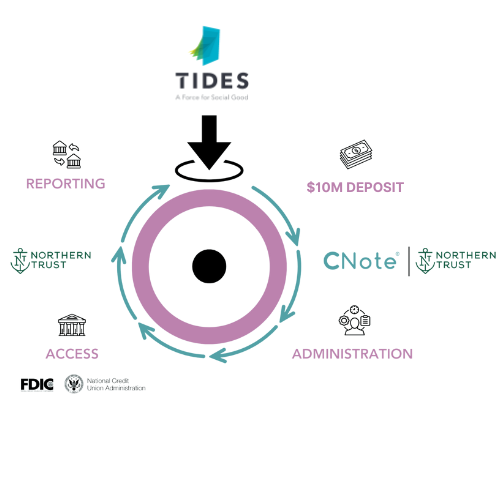

CNote simplifies how you can work with mission-driven financial institutions. Traditionally, deploying cash required navigating multiple steps, including identifying risk, analyzing data, negotiating rates, and maintaining transaction histories.

CNote streamlines this process into just three simple steps:

1. Financial Parameters and Impact Targets – Share your financial parameters and impact targets to align your goals and strategy.

Example: returns, duration, impact

2. Account Administration – CNote will match your parameters with our robust network, and will administer the opening of FDIC and NCUA insured accounts for you. Deposits are wired or transferred (ACH) to your FDIC and NCUA insured accounts at mission-driven financial institutions

Note: Northern Trust acts as our qualified custodian, holding and safeguarding client assets while facilitating all money movement and settlement activities. CNote handles administration hurdles and does not touch the money flow.

3. Receive reports and statements – All financial statements and reporting are communicated through your CNote dashboard or accounting software.

By leveraging CNote’s innovative platform, you gain access to a network of over 2,500 mission-driven financial institutions, including Self-Help Credit Union, Virginia Community Capital, Carver Bank, and more, without the hassle of managing each step yourself.

Ready to Do More with Your Cash?

Put your foundation’s operating cash to work with CNote. Earn competitive returns, maintain liquidity, and support communities across the country—without compromising the values you and your donors care about. With quarterly impact reports and full transparency, CNote makes it easy to align your financial strategy with your purpose and extend your impact, even before a grant is made.

Impact Cash®

Earn competitive blended return with CNote’s Impact Cash® while ensuring your money is safe, fully insured, and driving positive change. Your funds are placed in mission-driven financial institutions that support small business growth, affordable housing, disaster relief, and local economic development in underserved communities across the country.

![]() Competitive Blended Returns

Competitive Blended Returns![]() Cash with Impact

Cash with Impact![]() 100% FDIC and NCUA Insurance Coverage1

100% FDIC and NCUA Insurance Coverage1![]() Flexible Liquidity

Flexible Liquidity![]() Supports CDFI Banks and Credit Unions

Supports CDFI Banks and Credit Unions

Climate CashTM

Earn competitive blended return on your deposits with CNote’s Climate Cash™ while helping to combat climate change and support environmental resilience. Your fully insured deposits are placed in mission-driven financial institutions funding renewable energy projects, sustainable agriculture, green infrastructure, and other initiatives that build a more sustainable future.

![]() Competitive Blended Returns

Competitive Blended Returns![]() Combat Climate Change with your Deposits

Combat Climate Change with your Deposits![]() 100% FDIC and NCUA Insurance Coverage

100% FDIC and NCUA Insurance Coverage![]() Deposit up to $50M in Climate-Friendly Insured Deposits

Deposit up to $50M in Climate-Friendly Insured Deposits

Flagship Fund

Earn a potential 4.00% return with CNote’s Flagship Fund while supporting community development organizations that fund small business growth, affordable housing, and sustainable economic progress across America.

![]() An Easy Way to Start Impact Investing2

An Easy Way to Start Impact Investing2![]() Open to All Investors

Open to All Investors![]() Competitive Returns

Competitive Returns![]() Diversified CDFI Investment

Diversified CDFI Investment![]() 30-Month Term With Flexible Quarterly Liquidity3

30-Month Term With Flexible Quarterly Liquidity3![]() No Minimum

No Minimum

Impact Flex

Tailor your ImpactFlex fund to your Impact Theme, Geo, and Return. With CNote’s ImpactFlex, investors can choose causes that align with their values.

![]() Designed for Competitive Blended Returns

Designed for Competitive Blended Returns ![]() Invest in What Means the Most to You

Invest in What Means the Most to You![]() Drive Local Impact

Drive Local Impact![]() Exclusive Investment Opportunity for Accredited Investors and Institutions

Exclusive Investment Opportunity for Accredited Investors and Institutions

Make a Difference with Deposits.

See where how foundation’s deposits make a difference through Impact Stories from both Impact Cash® and Climate CashTM

As corporate treasury teams navigate the complexities of 2026, a significant shift is occurring in how organizations manage liquidity. While previous years focused on consolidating banking relationships for the sake of simplicity, modern treasury leaders are now prioritizing diversification without disruption. This approach allows for a broader distribution of capital without increasing the administrative burden […]

In a financial landscape where headlines often highlight market volatility, corporate treasurers are increasingly focused on the core fundamentals of capital preservation and security. While size is often equated with safety, stability is more often a product of discipline, transparency, and local integration. At CNote, we work with a vetted network of community-driven financial institutions, […]

When markets turn volatile, we’ve seen a similar cash management playbook: Pull back.Consolidate cash.Lean harder on the biggest banks. It feels like the responsible thing to do. Big logos, long histories, familiar names, all of it signals “safe” when the headlines are noisy. At the same time, anything labelled impact often gets mentally filed under […]

When treasury teams talk about cash, the focus is usually clear:safety, liquidity, yield. But there’s another, quieter story playing out in the background. Across the U.S., community banks and credit unions are using deposits to support financing affordable housing, small business growth, and neighborhood revitalization often in places traditional finance overlooks. Community-driven deposit administration platforms, […]

Growing Up in Summerville: The Roots of Innovation David Parker’s journey from small-town Summerville to running a thriving business is rooted in his hard work, ingenuity, and the unwavering support of his community. Growing up, he wasn’t just a curious child—he was a natural problem-solver. Raised on a family farm, David learned early that when […]

Subscribe to CNote’s Newsletter: A Strong Yield

Subscribe to CNote’s corporate newsletter and gain industry insight and education on Impact Deposits and Investing.

- Impact Cash® deposits are insured by the FDIC or NCUA, subject to the terms and conditions of the Impact Cash agreements. CNote Group, Inc. (CNote) is not a bank, a credit union, or any other type of financial institution. CNote is not a registered investment advisor with the Securities and Exchange Commission (SEC) or a broker-dealer authorized by the Financial Industry Regulatory Authority (FINRA). CNote is not a legal, financial, accounting or tax advisor. CNote does not negotiate interest rates. Impact Cash deposits are not securities or investments. We encourage you to consult with a financial adviser or investment professional to determine whether or not the CNote platform makes sense for you.This information should not be relied upon as investment or financial advice. Any projected returns are illustrative, interest rates are set by the depository institutions and are subject to change at any time.

- Returns are not guaranteed. The Flagship Fund issues Adjustable Rate Promissory Notes that are non-recourse obligations of CNote and involve the risk of loss, including principal. You should carefully review the all offering documents including note terms prior to investing.

- CNote has management discretion around liquidity and currently offers clients quarterly liquidity up to $20,000 or 10% of invested assets, whichever is greater. At a minimum, CNote investors will have access to 10% of their investment every quarter. For full investment terms see the Offering Circular for unaccredited investors and the Private Placement Memorandum for accredited investors