What is Impact Cash®?

Make a difference with your cash deposits.

Impact Cash® is a 100% FDIC/NCUA-insured cash management solution designed for corporations, foundations, and individuals. Every dollar you deposit remains fully insured, providing you with security and peace of mind while contributing to a positive impact in underserved communities.

A More Impactful

Cash Management Solution

Available to Individuals, Corporations, and Foundations

Accessible to individual investors with a minimum investment of $50,000, as well as corporations and foundations.100% FDIC and NCUA Insured

Designed to be 100% insured via FDIC and NCUA programs, providing positive social impact with the peace of mind that deposits are backed by the full faith and credit of the United States government.

Flexible Liquidity

Funds are available on demand, subject to potential early withdrawal penalties assessed by our community partners.

Scalable

CNote only partners with mission-driven financial institutions which regularly report on the community development activity they’re achieving.

Impact

CNote partners only in mission-driven financial institutions. CNote reports regularly on the change Impact Cash® holders are achieving.

Ease of Use

Access multiple mission-driven financial institutions with a single account, all online.

CNote is a

Trusted Partner

“With the expertise, technology, and vision to align corporate cash with meaningful social impact. By addressing the U.S. wealth gap, CNote empowers underrepresented businesses and entrepreneurs in underserved areas, driving sustainable change and economic growth.”

— Jeffrey Whitford, Vice President, Sustainability & Social Business Innovation

Life Science | Strategy & Transformation, A business of Merck KGaA, Darmstadt, Germany

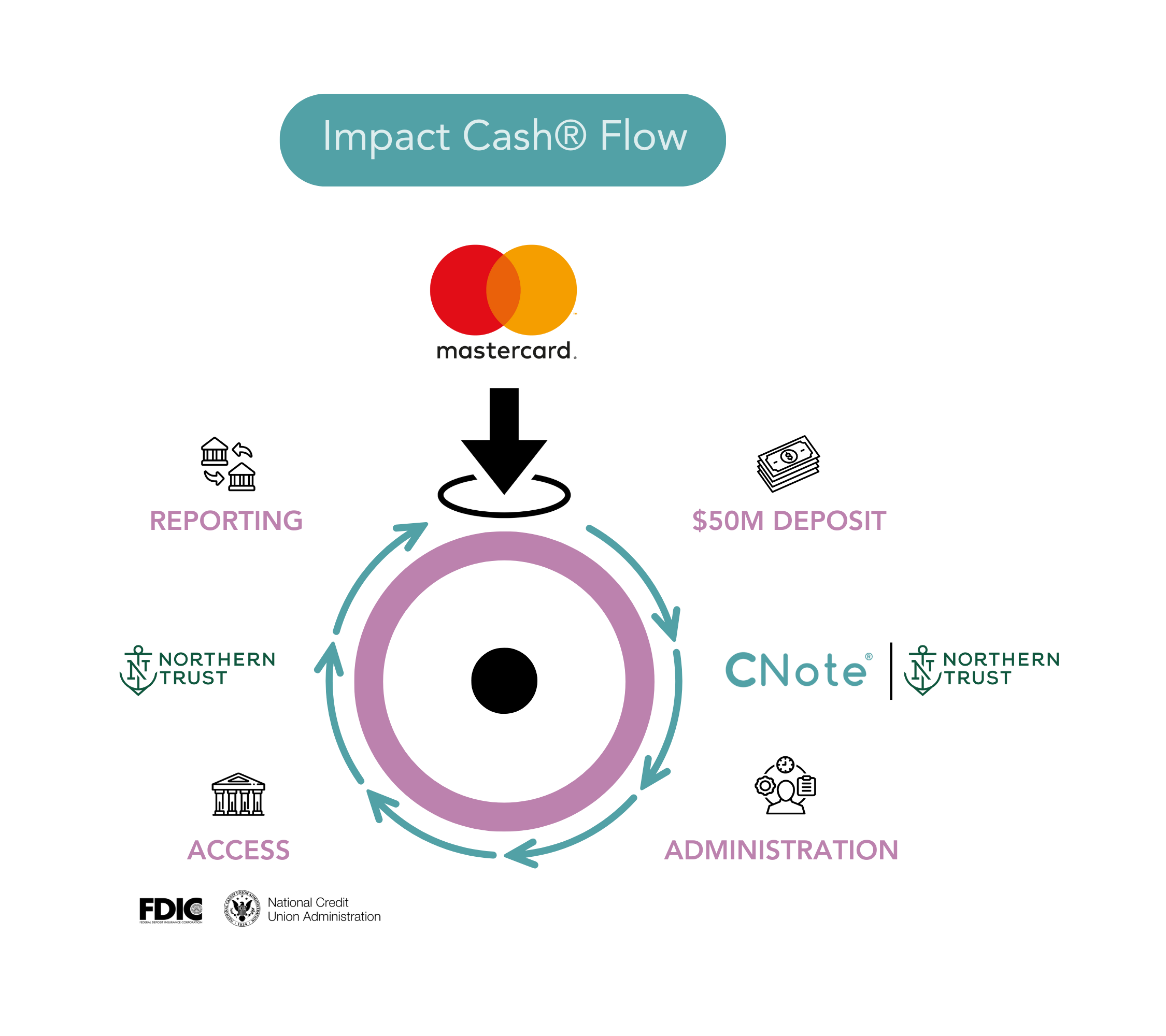

The Impact Cash® Flow

Impact Cash® takes your deposits and turns them into a force for good. With 100% FDIC/NCUA insurance, your funds are securely placed into mission-driven financial institutions, such as CDFI banks and credit unions, handpicked to align with your impact goals, geographic preferences, and organizational needs.

Through a seamless custodian partnership with Northern Trust, CNote deploys your dollars toward mission-driven financial institutions focused on initiatives that matter—affordable housing, small business growth, racial equity, disaster recovery, and climate resilience—directly strengthening communities.

But the impact doesn’t stop there. You’ll receive quarterly updates with detailed metrics and inspiring stories, showing exactly how your deposits are driving positive change. With CNote, you’re not just safeguarding your funds; you’re making a tangible difference in the world.

Why Choose

Impact Cash®?

![]() Peace of Mind: Fully insured deposits (100% FDIC/NCUA) ensure your funds are protected.

Peace of Mind: Fully insured deposits (100% FDIC/NCUA) ensure your funds are protected.

![]() Competitive Market Returns: Earn a blended return while aligning your cash with your values.

Competitive Market Returns: Earn a blended return while aligning your cash with your values.

![]() Direct Impact: Support the causes you care about, from environmental sustainability to economic empowerment.

Direct Impact: Support the causes you care about, from environmental sustainability to economic empowerment.

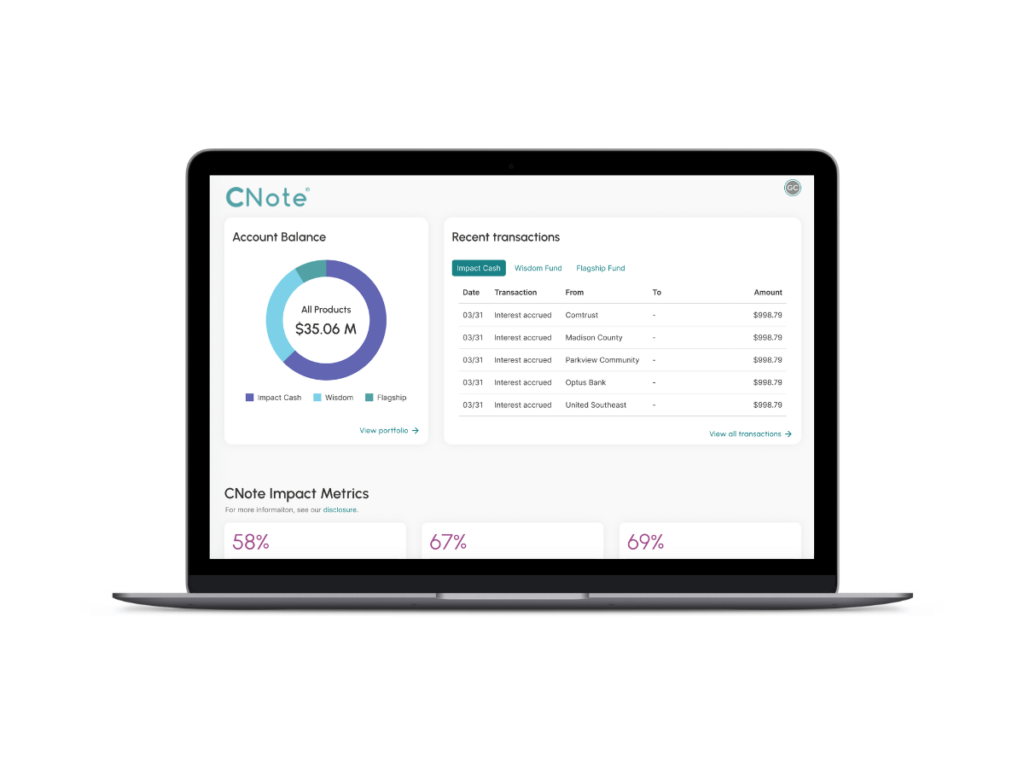

![]() Effortless Management: An easy-to-use online portal simplifies funds management, so you can focus on what matters most.

Effortless Management: An easy-to-use online portal simplifies funds management, so you can focus on what matters most.

Your Money, Your Impact

Since January 2023, CNote’s Partner Institutions have Originated:

Illustrative Impact Cash® Beneficiaries.

Where your cash deposits can make a difference. CNote actively shares and reports the impact your dollars are making allowing you to keep up to date on how your cash deposits are making a difference. Stories featured on CNote’s blogs are stories shared and reporting by our financial partners

Growing Up in Summerville: The Roots of Innovation David Parker’s journey from small-town Summerville to running a thriving business is rooted in his hard work, ingenuity, and the unwavering support of his community. Growing up, he wasn’t just a curious child—he was a natural problem-solver. Raised on a family farm, David learned early that when […]

Understanding what resonates with investors is essential to directing more mission-aligned capital to mission-driven depository institutions (DIs) making a difference in underserved communities. To deepen this understanding, CNote recently analyzed investor engagement across multiple channels to identify the impact themes that consistently drive interest and investment. There is a key opportunity to build on this […]

In 2012, Jeff Trudeau, a seasoned concrete truck operator, saw a growing environmental crisis within the industry he knew so well. Every day, concrete trucks across New England faced a major problem: the improper disposal of washout water. This water, laced with concrete particles and possessing a dangerously high pH, posed a significant environmental threat, […]

Over the span of 48 hours in mid-July 2023, most of Vermont was battered with record amounts of rainfall, resulting in catastrophic flash flooding. As the state’s rivers swelled, homes were submerged, roads and bridges were washed out, and, tragically, at least two lives were lost. The 500-year flooding event devastated communities across The Green […]

Partners

By working with some of the country’s most inspiring and dedicated leaders, Impact Cash® drives capital and new opportunities into the hands of underserved communities across the United States. CNote partners are committed to co-creating the product alongside the community we aim to serve.