-

CNote CEO Cat Berman Wins Treasury Today’s Leading Light Award

May 8, 2025 – CNote, a financial technology platform focused on community investment, is proud to announce that its Co-Founder and CEO, Cat Berman, has been named the 2025 Leading Light Award winner by Treasury Today’s Women in Treasury Awards. The Leading Light Award is one of Treasury Today’s most prestigious honors, celebrating individuals who

-

Expanding Access to Pediatric Care: How Samuel Rodgers Health Center and Central Bank of Kansas City Are Building a Healthier Future

In Kansas City’s most low-income neighborhoods, families face growing barriers to accessing consistent, high-quality healthcare—especially for children covered by Medicaid. For decades, Samuel U. Rodgers Health Center (Sam Rodgers) has been a cornerstone of care for the community, offering comprehensive health services to patients regardless of income, insurance status, or background. In 2024 alone, the

-

Celebrating Our Journey: A Year of Innovation & Inspiration

This week marks another birthday for CNote—and with it, a moment to reflect on how far we’ve come, the momentum we’ve built, and where we’re heading next. From an early vision of financial innovation for good, CNote has grown into a trusted platform for values-aligned investing—serving institutional and individual clients, expanding our suite of products,

-

Are Corporations Leaving Money on the Table by Overlooking Community Banks?

In today’s economic climate, uncertainty is a given. Interest rates are fluctuating, markets are shifting, and corporate finance teams are being asked to do more with less—while still preserving capital, ensuring liquidity, and managing risk. In times like these, the way companies manage their cash matters more than ever. Many corporations are reevaluating their treasury

-

Why Geography Matters: Rethinking Where You Bank

When most people think about where to keep their money, they focus on interest rates, digital convenience, or brand familiarity. Rarely do we consider geography — the physical location of a bank or credit union — as an important factor in that decision. But geography plays a surprisingly powerful role in how your money is

-

florrent and CNote: A Mission-Driven Partnership for Impactful Treasury Management

florrent is a minority-led, Massachusetts-based startup pioneering high-performance energy storage solutions. Their next-generation supercapacitors provide a cost-effective and sustainable alternative to traditional power quality and reliability technologies, ensuring firm power at every level of the grid. More than an energy innovator, florrent is committed to reshaping the clean energy economy to benefit all communities, building

-

How Genesis Helped Shalom House Transform a Historic Property into Supportive Housing for People with Substance Use Disorder

In 2018, the closure of Serenity House, a long-running sober living facility in Portland, left a critical gap in housing and treatment resources for local individuals experiencing homelessness and substance use disorder. The historic property at 30 Mellen Street had been a beacon of hope, but, empty, it highlighted Portland’s pressing need for supportive housing

-

Where Your Money Actually Goes: The Hidden Power of Depositing in Community Banks

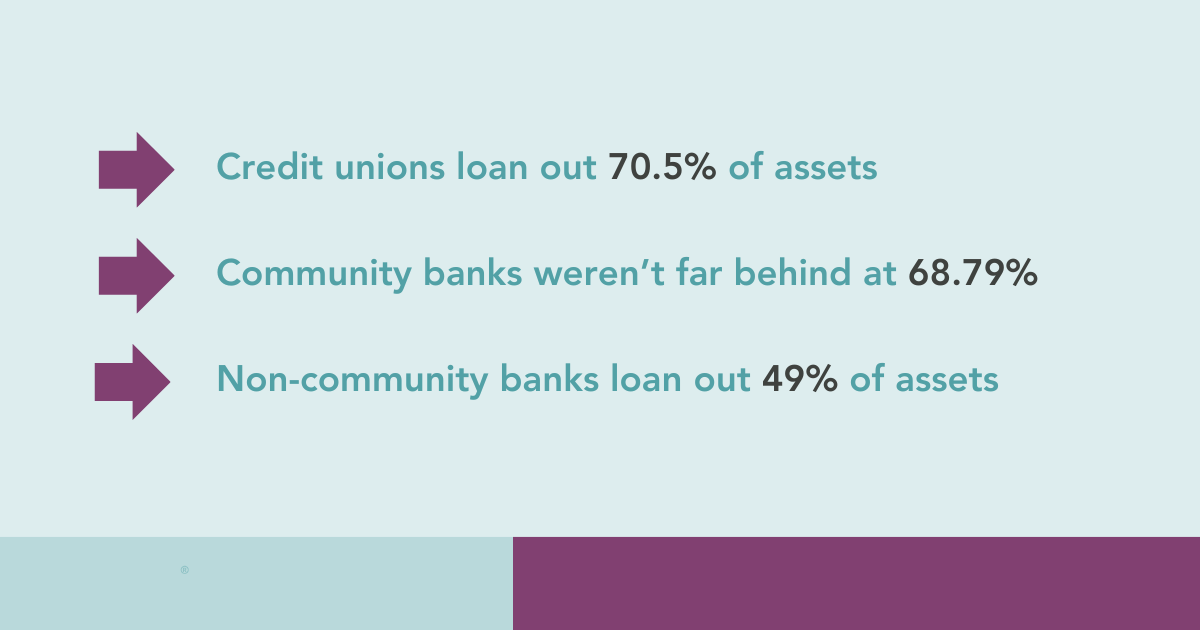

When you place funds in a bank, what happens next? Most people assume their money just sits there until they need it. But in reality, every deposit has the potential to power businesses, support families, and strengthen local economies—if it’s placed in the right hands. Community banks and credit unions are leading the way when

This website uses cookies to improve your experience. We\'ll assume you\'re ok with this, but you can opt-out if you wish. Read More