When it comes to managing institutional cash, yield matters — but so does impact. Today’s treasury and finance leaders are increasingly seeking both competitive returns and opportunities to align their deposits with community impact. CNote’s latest Impact Cash® Money Market Rate Card demonstrates that community banks and mission-driven depository institutions are not only competitive but are also changing the conversation around cash management.

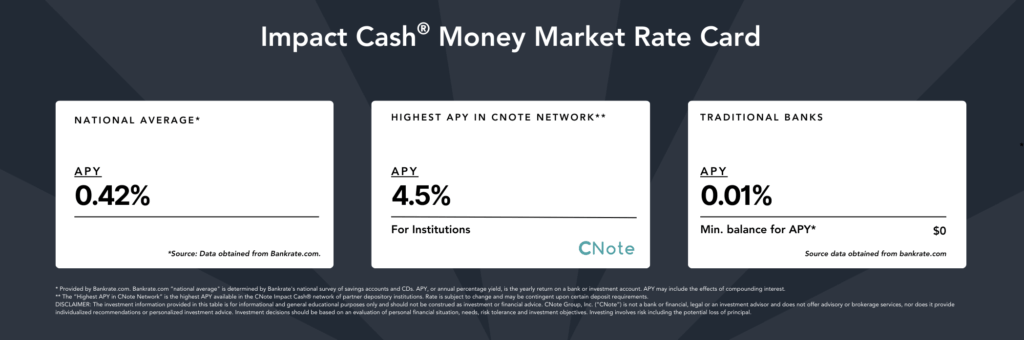

Let’s look at the numbers:

- National Average APY*: 0.42% (Source: Bankrate)

- Some Traditional Banks’ APY*: 0.01% (with a $100 minimum balance) (Source: Bankrate)

- Highest APY in the CNote Network**: 4.5% for institutions

These numbers are telling. While traditional banks continue to offer steady and reliable options, community-focused institutions in CNote’s network are providing rates that stand out for institutions seeking both competitive yields and positive community impact.

The Yield Advantage

In an environment where every basis point counts, community banks and mission-driven institutions have become an attractive alternative. By accessing CNote’s network of vetted, impact-driven depositories, institutional investors can achieve yields up to 4.5% APY* — a staggering difference compared to traditional options.

Unlike traditional banks, which may be weighed down by scale, overhead, or conservative lending strategies, community banks and CDFIs (Community Development Financial Institutions) can often offer more competitive rates to attract deposits. According to the Federal Reserve remarks on Community Banking, community banks play a crucial role in serving local economies, particularly in rural and underserved areas, offering relationship-based lending and supporting small business development (source: Federal Reserve).

Beyond Yield: Supporting Local Economies and Small Businesses

Choosing a community bank isn’t just a financial decision — it’s a vote for local prosperity. Deposits placed with CNote’s partner institutions fuel small business growth, affordable housing initiatives, and disaster recovery efforts. Every dollar supports entrepreneurs, families, and communities that are often overlooked by larger financial institutions.

By redirecting cash reserves toward these community-focused banks, corporations and institutions can:

- Strengthen Local Economies: Deposits become working capital for small businesses, job creation, and neighborhood revitalization. (Source: FDIC)

- Support Underserved Communities: Capital flows into regions that traditional banks often deem too risky. Allowing institutions to allocate cash to support communities important to their business.

- Meet Impact and Financial Goals: Without sacrificing liquidity or returns, institutions can demonstrate leadership in social responsibility.

A Strategic Advantage for Corporate and Institutional Investors

Driving Impact through insured cash management solutions like Impact Cash® offers a rare win-win. Institutions gain access to competitive yields, FDIC and NCUA insured security, and a powerful story about how their cash is working to make a difference.

CNote’s platform makes it seamless to direct deposits into a diversified network of mission-driven banks and credit unions, offering clients the transparency, security, and impact reporting they need to meet both fiduciary and social objectives.

The Bottom Line

In a landscape where traditional banks continue to offer minimal yields, community banks are stepping up — providing both stronger financial returns and meaningful social impact. Partnering with community banks not only addresses corporate liquidity needs but also supports the broader mission of building stronger, more resilient local economies throughout the United States.

Choosing to place institutional cash in CNote’s Impact Cash® network isn’t just smart business. It’s a commitment to building a stronger, more equitable economy — one deposit at a time.

Ready to make your cash work harder — for you and your community? Learn more about CNote’s Impact Cash® solution here.

* Provided by Bankrate.com. Bankrate.com “national average” is determined by Bankrate’s national survey of savings accounts and CDs. APY, or annual percentage yield, is the yearly return on a bank or investment account. APY may include the effects of compounding interest.

** The “Highest APY in CNote Network” is the highest APY available in the CNote Impact Cash® network of partner depository institutions. Rate is subject to change and may be contingent upon certain deposit requirements.